Annual Report 2016

Annual Report 2016 for the Chartered Trading Standards Institute (CTSI)

1. Contents

- Introduction

- Overviewing membership and the wider sector

- Governing the Code

- Promoting the Code

- Monitoring compliance with the Code

- Enforcing compliance with the Code

- Invoking non-compliance action

- Convening the indpendent Non-Compliance Panel

- Convening the independent Appeals Panel

- Resolving consumer disputes in respect of members

- Resourcing the RECC team

- Looking ahead

2. Introduction

This Annual Report has been produced for the Chartered Trading Standards Institute (CTSI). It sets out the Renewable Energy Consumer Code’s principal achievements during the 2016 calendar year. RECC is approved by CTSI under the Consumer Codes Approval Scheme (CCAS). The Code was first approved by Office of Fair Trading in 2007 (Stage One) and in 2011 (Stage Two). 2016 was the eleventh full year of the Renewable Energy Consumer Code.

3. Overviewing membership and the wider sector

Renewable Energy Consumer Code (RECC) is designed specifically for businesses that sell, lease and/or install small-scale renewable energy generators and related products. We bring twelve years of experience in renewable energy as the basis for promoting high standards of protection for consumers, thereby promoting simultaneously the reputation of our members and the wider sector in which they operate.

RECC takes its role very seriously and we do all we can to provide our members with in-depth training and guidance to help them raise their game. From 2006 to 2015 RECC was the only CTSI-approved consumer code in the sector. In August 2015 CTSI approved a second consumer code, and in 2016 approved a third consumer code .

A small-scale renewable energy generating system can represent a very significant investment for consumers when compared with other investment decisions they make. For this reason consumers must have accurate information in advance of signing a contract, in a format that they can readily understand and compare with other offers they receive.

Any business that agrees a contract with a consumer must be certified by the Microgeneration Certification Scheme (MCS) if the consumer is to benefit from Government financial incentives such as the Feed-In Tariff (FiT) and Renewable Heat Incentive (RHI). Any businesses seeking MCS certification must first be a member of a CTSI-approved consumer code such as RECC.

Going forward there are new products coming to market. Many of them do not attract any form of susbsidy and therefore installers are not bound by the MCS / CTSI safety net. Nonetheless the Code extends to these ‘related products’ now and we encourage all contractors to be a RECC member and comply with the Code. In return we offer installers detailed guidance, training and one-to-one advice to ensure good practice and a high level of consumer protection.

3.1 Overviewing RECC membership

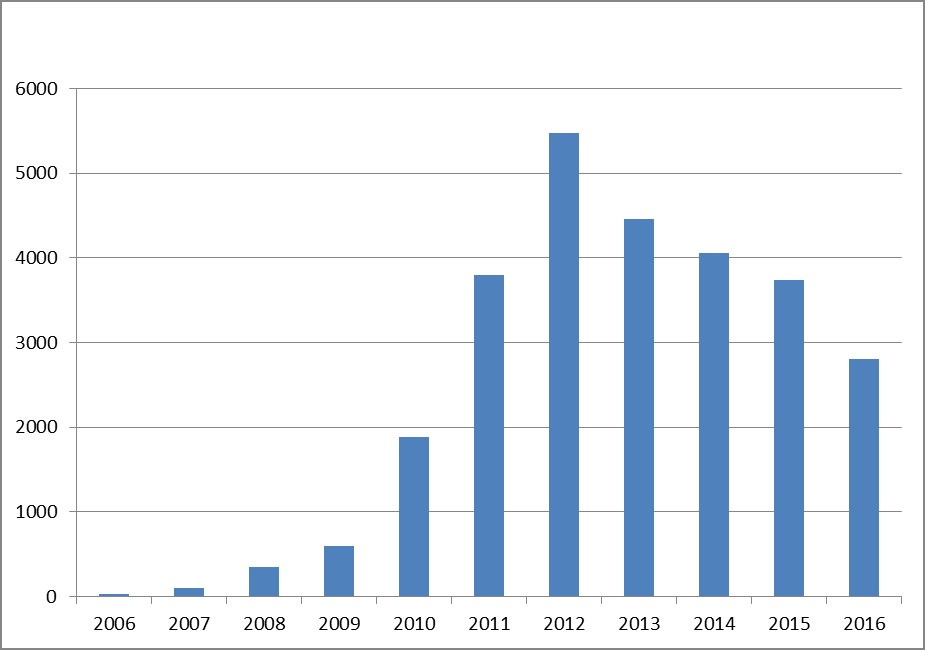

RECC’s membership grew steadily from just 30 members in 2006 to 5,500 in 2012. The next years have seen a decline in number of members following reduced FiT and RHI rates and the introduction of capacity caps. The majority of RECC members continue to sell and install solar PV systems, most paid for by means of consumer finance. However, 2014 saw the introduction of the domestic RHI with more heating and plumbing businesses among RECC members as a result. 2016 was the second full year of the domestic RHI.

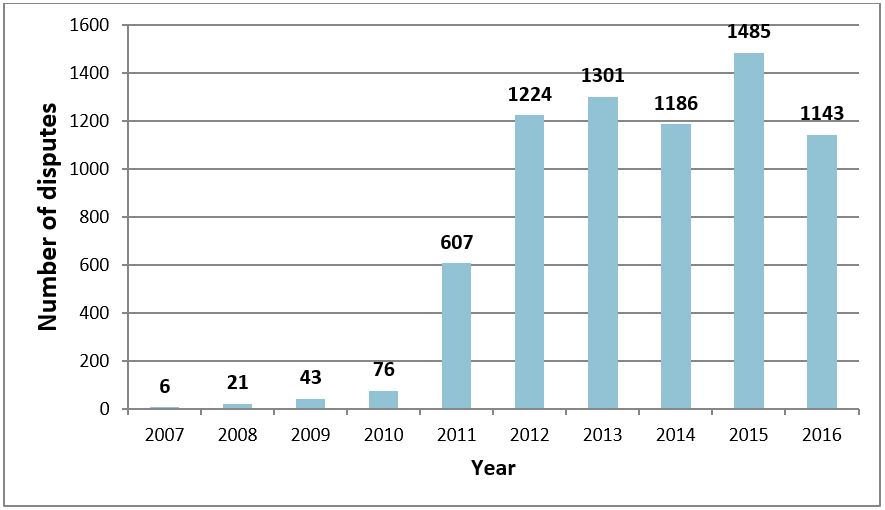

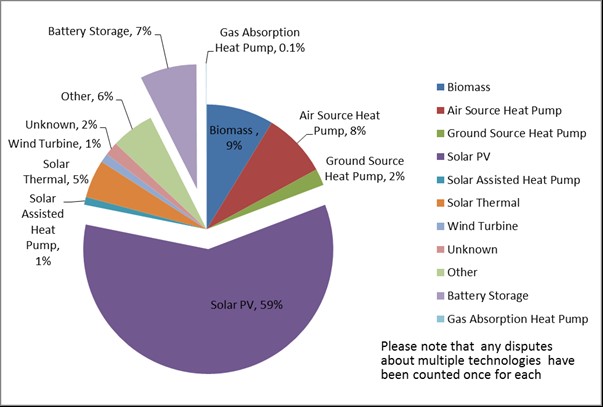

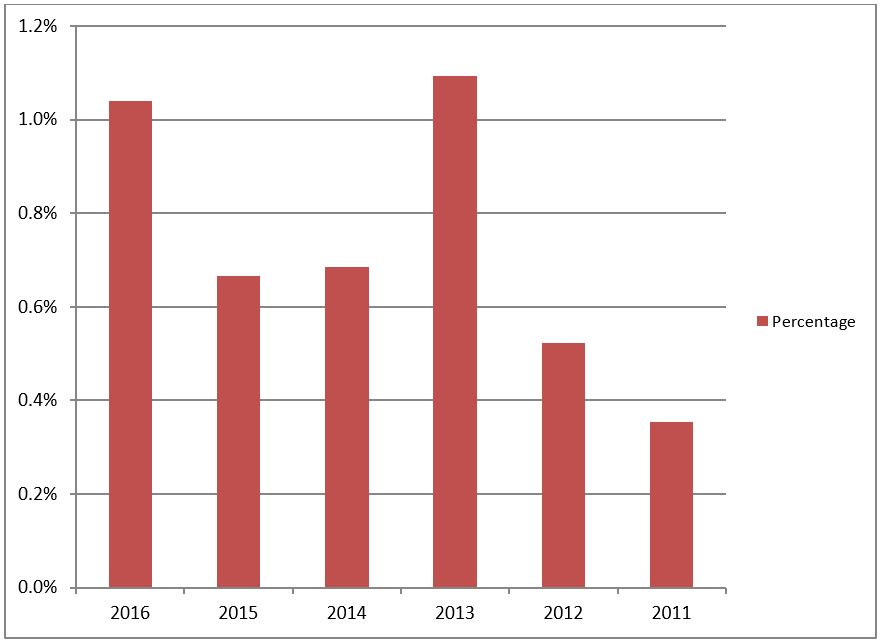

The number of disputes registered with RECC fell in 2016 with 1,143 disputes registered, down 21 % from 1,452 in 2015. In 2016, once again, the majority of disputes were about solar PV installations (59 per cent). The percentage of all domestic solar PV installations during the year which resulted in a dispute registered by RECC in 2016 has increased to 1 per cent from 0.7 per cent in 2015. (See page 37 for more details.)

Fig 3.1 RECC Membership by year

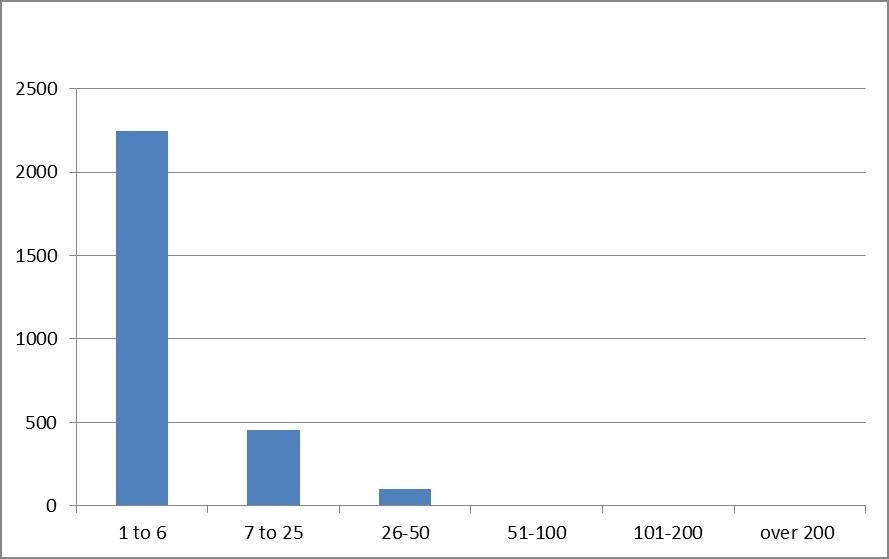

Fig 3.2 RECC membership in 2016 by number of employees

(Membership categories correspond to the total number of employees involved in renewable energy activities, including backroom staff and sales representatives, even when these are not directly employed by the company. The membership category is verified during audit.)

3.2 The wider sector

The figures in this section show the wider context within which the Code sits. Our thanks to Ofgem and BEIS for the charts:

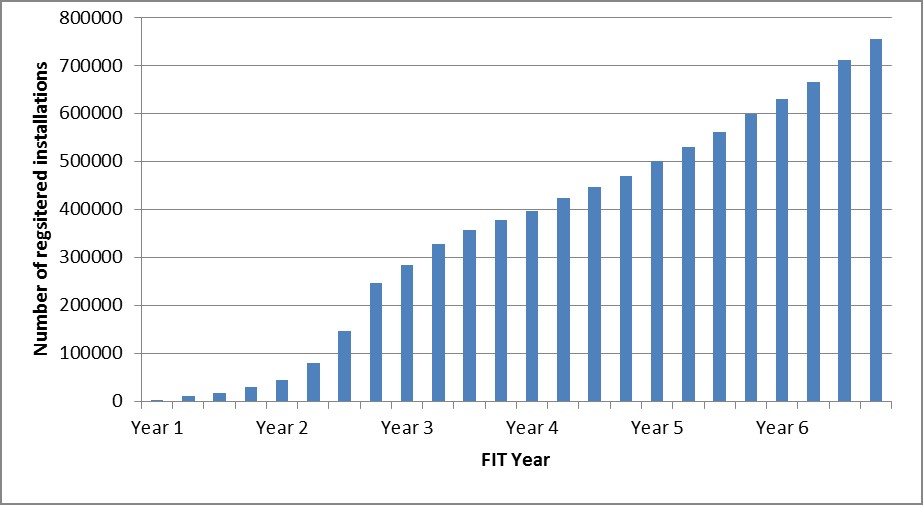

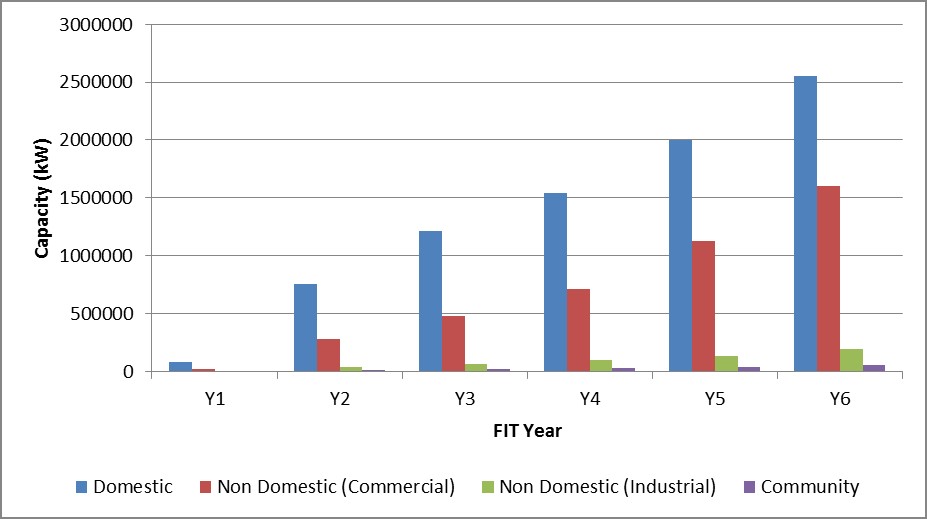

Figure 3.3 shows the total number of installations under the Feed-In Tariff from the introduction of the scheme in April 2010 to the present. provide a breakdown of the number of solar PV installations registered each month since the Feed-in Tariff was introducted in April 2010. Figure 3.4 shows the breakdown of installed capacity by domestic, commercial, industrial and community over the same time period.

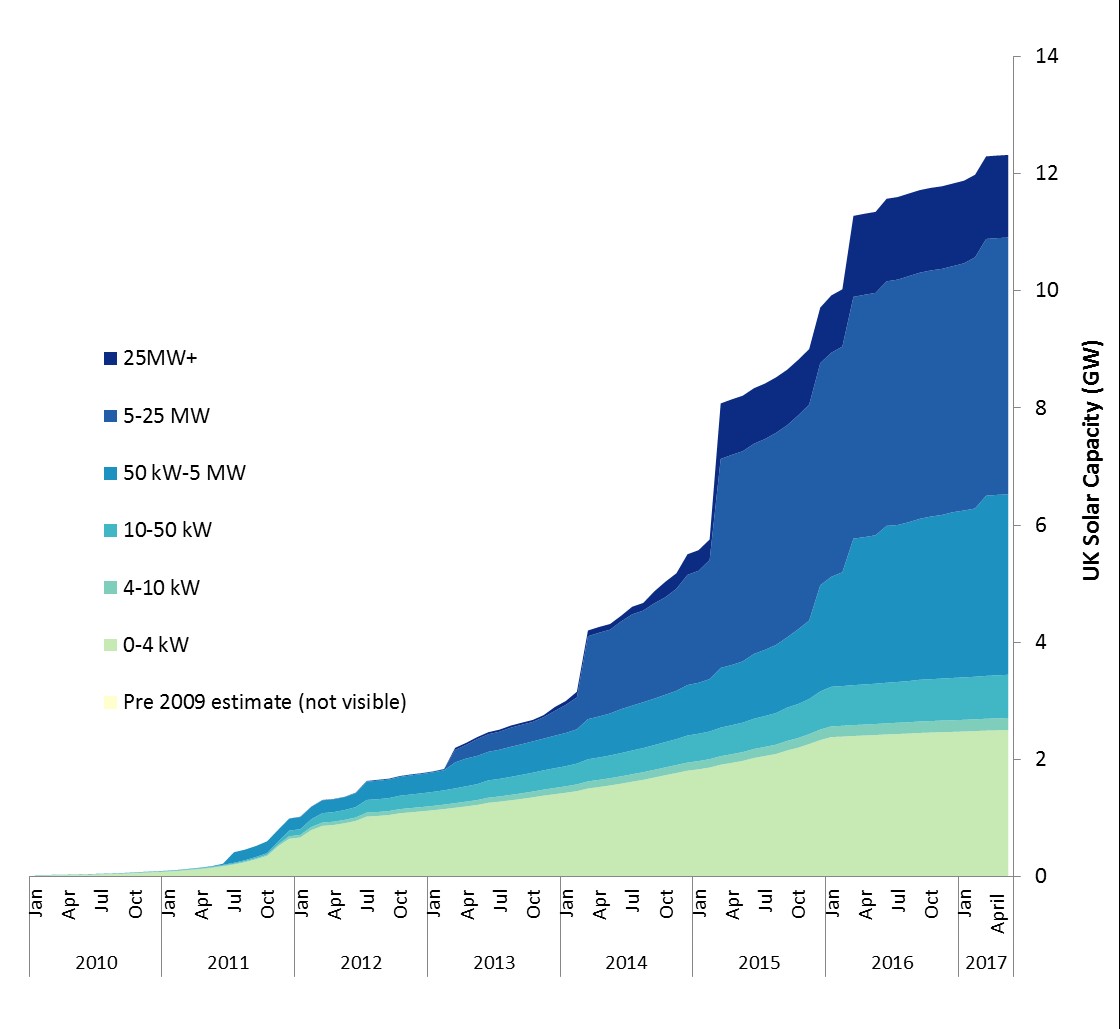

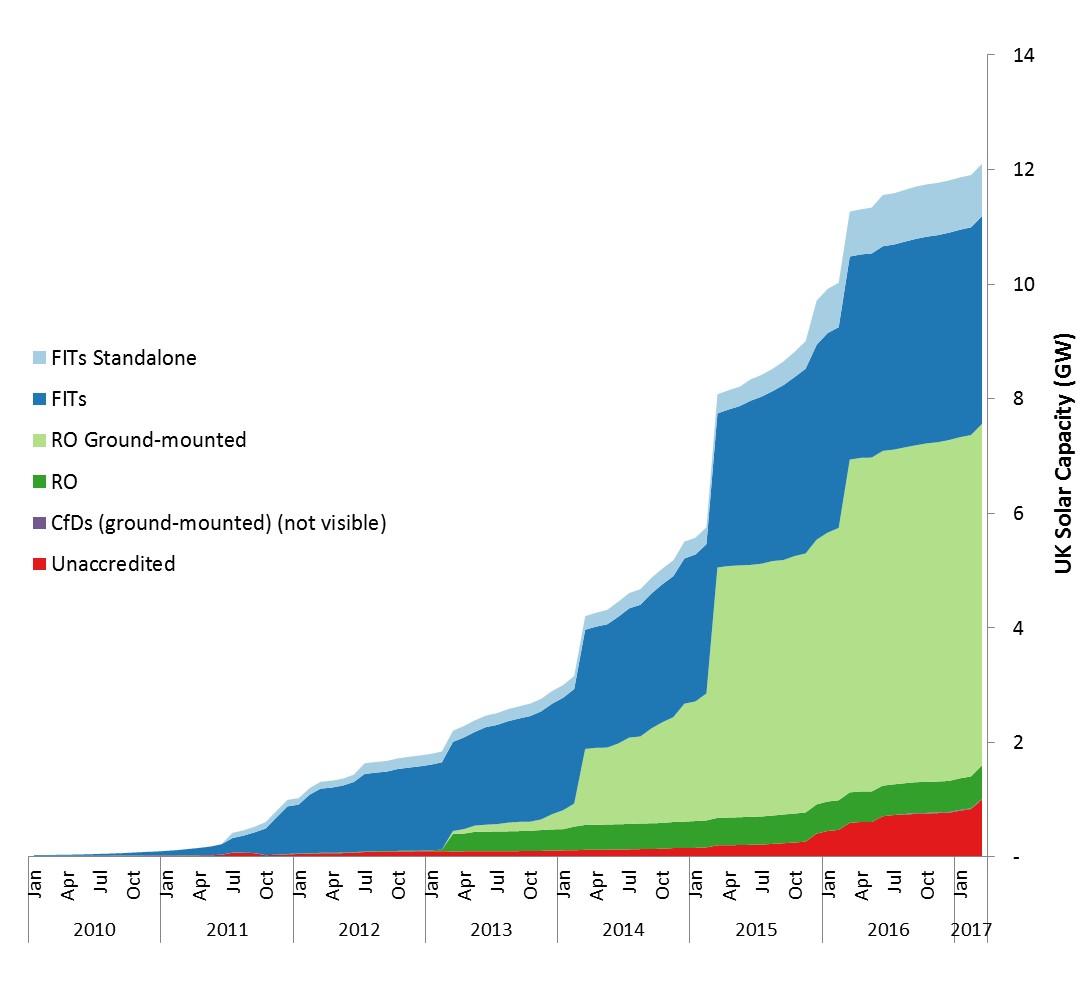

Figure 3.5 shows the total solar PV deployment broken down by capacity band, with the smallest category (< 4 kWp) at the bottom. Finally, Figure 3.6 shows the breakdown of solar PV deployment broken down by the relevant incentive scheme, with the Feed-in Tariffs second from the top. It shows the dramatic growth in ground-mounted solar PV since 2014.

Fig 3.3 Number of installations registered for FiT from April 2010

Fig 3.4 Total installed capacity by installation type for FiT from April 2010

Source: Figures 3.3 and 3.4: Ofgem: www.ofgem.gov.uk/system/files/docs/2017/01/fit_annual_report_2016.pdf

Fig 3.5 UK solar PV deployment by capacity band and year

Fig 3.6 UK solar PV deployment by accrediation

Source: Figures 3.5 and 3.6: BEIS: www.gov.uk/government/statistics/solar-photovoltaics-deployment

4. Governing the Code

RECC is administered by Renewable Energy Assurance Ltd (REAL) with a Board of Directors, both Executive and Non-Executive. REAL was registered with Companies House in February 2006 and has the company number 05720606. REAL is a wholly-owned subsidiary of Renewable Energy Association (REA), the leading trade association in the renewables sector, a not-for-profit company. The Supervisory Panel, which meets quarterly, advises on the running of the Code.

4.1 Updating the Code

The Code sets out the relationship between RECC members and consumers. The Supervisory Panel oversees the Code which is a living document and has to reflect developments in the policy, legal and industry context within which it operates. CTSI also requires us to reflect the lessons drawn from our monitoring activities, any feedback we receive and the disputes we register. In addition we take account of guidance and specific suggestions we receive from CTSI, the Supervisory Panel, the REAL Board of Directors, the Primary Authority and consumer-facing organisations.

The Code has been adapted and revised annually since it was first drafted in early 2006. It was amended in October 2016. The amendments were intended to:

- take account of the introduction of Consumer Rights Act 2015;

- provide more clarity around the assignment of rights models and ‘related products’ linked to energy generators including battery storage;

- bring the Code into line with recent changes to the RECC Bye-Laws;

- make explicit reference of the need to keep records;

- increase the minimum level of public liability insurance to £2 million, in line with the Competent Persons Scheme;

- update finance sections to be fully in line with FCA regime;

- update references to the CAP Code and the BCAP Code;

- include the Privacy and Electronic Communications (EC Directive) Regulations;

- change references to ‘complaint’ into ‘dispute’ and ‘complaint handling’ into ‘dispute resolution’;

- update insurance-backed warranty section;

- take account of the introduction of the ADR Regulations 2015;

- remove section on independent conciliation service which is no longer required or offered;

- update definitions, glossary, lists and contact details at the end of the Code.

4.2 Updating the Bye-Laws

The RECC Bye-Laws govern the relationship between RECC and its members. The REAL Board of Directors is responsible for adopting and overseeing the Bye-Laws which are reviewed from time to time in parallel with the Code. The Bye-Laws were updated in March 2016 to reflect the fact that the independent Applications, Non-Compliance and Appeals Panels now operate on behalf of all CTSI approved consumer codes in the sector. (A joint Protocol to this effect was signed on 11 April 2016. The signatories were: CTSI, RECC, HIES and GGF. You can find a copy here: www.recc.org.uk/pdf/joint-protocol-for-panels.pdf.)

4.3 Overseeing the Code

The Supervisory Panel oversees and advises on the running of the Code. Its governance arrangements are set out in full in the RECC Bye-Laws. Its members are independent of the RECC Executive and a majority of them, including the Chair, are also independent of the sector. The Panel’s responsibilities include:

- reviewing and updating the documentation relating to the Code and the scheme;

- overseeing the implementation of the Monitoring Strategy;

- reviewing RECC Members’ complaince with the Code based on the results of monitoring activities;

- establishing such Expert Groups as it may consider necessary to advise it; and

- reviewing any reports presented to it by the Executive.

In 2016 the Panel met four times, on: 16 March, 8 June, 14 September and 14 December. David Laird has been the Chairman of the Panel since August 2012. The Minutes of the Supervisory Panel Meetings are available on the website here: www.recc.org.uk/scheme/supervisory-panel/meetings-notes.

In 2016 the Supervisory Panel members were as follows:

Supervisory Panel Members

| David Laird | Chairman |

| Bryn Aldridge | Indpendent expert, formerly City of London Trading Standards |

| Walter Carlton | Deloitte |

| Cameron Carswell | Solar Trade Association |

| Amanda Clark | Certsure |

| David Frise | B&ES |

| Frank Gordon | REA |

| Zoe Gujerro | Citizens Advice |

| Gretel Jones | Independent consumer expert |

| Steve Lisseter | Independent consumer and competition issues expert, formerly Director of Consumer Codes at the OFT |

| Brendan Murphy | MCS Administrator |

| Gideon Richards | MCS Chairman |

| Christine Schams | BEIS (observer) |

| Neil Schofield | Worcester Bosch |

| Dave Sowden | Sustainable Energy Association |

| Jim Thornycroft | Independent solar PV expert |

| Philip Wolfe | Independent renewables expert |

| Chris Wood | Ofgem (observer) |

5. Promoting the Code

Throughout 2016 RECC has continued to take every opportunity to promote the benefits of the Code, and the consumer protection it offers, including through:

- attending and presenting the Code at industry and other related conferences and exhibitions;

- contributing to Government-run roadshows;

- publishing a quarterly newsletter to update members with developments in the Code and the wider sector;

- ensuring that only RECC members use the RECC logo and that they use it correctly and in line with the guidelines on the website;

- informing members about how they can use the CTSI approved logo and be listed on the associated My Local Services website;

- providing members with high-quality leaflets explaining the key provisions of the Code and requiring them to provide these leaflets to consumers;

- producing and circulating widely a set of ‘Top Tips’ for consumers to consult to avoid ‘being taken for a ride’ when signing a contract;

- liaising with regulatory and other bodies, including Trading Standards departments, Citizens Advice Consumer Service, the Advertising Standards Authority (ASA), Energy Saving Trust (EST), the Financial Conduct Authority (FCA) and the Companies Investigation Branch of the Insolvency Service;

- liaising with finance providers active in the small-scale renewables sector;

- liaising with insurance providers who offer insurance-backed warranty products in the small-scale renewables sector;

- making sure the Code is clearly linked from other websites including: MCS, MCS Certification Bodies, EST, British Standards Institute (BSI), ASA, Department of Energy and Climate Change (DECC) etc;

- responding to media enquiries; and

- providing evidence to Government and other bodies in response to consultations on, for example about the FITs, the domestic RHI and the wider energy efficiency market.

RECC has continued to protect the reputation and integrity of the Code in 2016 by:

- carrying out in-depth due diligence checks on all those applying to join the Code;

- carrying out frequent audit compliance checks to ensure that all members are complying fully with the Code and Bye-Laws;

- continuing to develop a wide range of guidance and model documents freely available to members and applicant members;

- expanding to develop the comprehensive online training resource freely available to members and applicant members; and

- hosting regular training webinars free to access for members.

5.1 Enhancing the services RECC provides to members

During 2016, RECC continued to develop and enhance the range of services it offers to members in several important ways. Below are some examples.

5.1.1 Guidance on batteries and solar power

In January 2016 RECC launched its guidance for domestic and small commercial consumers on batteries and solar power. This document, available online and in hard copy, explains how battery storage works and sets out the factors which consumers need to take into account in deciding whether to install a battery storage system alongside their solar PV system. RECC drafted the guidance with BRE National Solar Centre. It is designed to dovetail with BRE National Solar Centre’s technical guide on how to use energy storage with grid-connected solar photovoltaic systems for installers.

An important element of RECC’s guidance is the list of 20 questions which we advise consumers to ask installers before signing a contract. This list is mirrored in the separate guidance for installers. It focuses on the pre-sales information installers should provide consumers along with guidance for presenting financial benefits and suggested wording for proposals.

RECC has set up a specific Storage section on the website containing useful information and links to all relevant guidance and technical information. In October 2016 RECC updated the Code to make clear that its provisions extend to ‘related products’ . Finally, the RECC dispute resolution team is available to assist consumers and members with disputes about domestic battery storage systems.

You can find RECC’s guidance on batteries and solar power here: www.bre.co.uk/filelibrary/nsc/Documents%20Library/NSC%20Publications/88166-BRE_Solar-Consumer-Guide-A4-12pp-JAN16.pdf

And here: www.recc.org.uk/pdf/guidance-on-battery-storage.pdf

You can obtain a copy of BRE National Solar Centre’s technical guide from the BRE bookshop here: www.brebookshop.com/index.jsp . (Please note that there is a £25 charge for it.)

(A ‘Related Product’ is defined in the Code as: ‘any product supplied which will be connected or linked to the Energy Generator in any way (for example, this includes inverter, generation meter, ground loop, battery storage unit, voltage optimiser, immersion boost or remote monitoring device)’. An ‘Energy Generator’ is defined in the Code as: ‘any renewable or low carbon small-scale heat and power generator (this may include systems mounted on the roof or the structure of a building, or those mounted nearby within the Consumer's grounds)’.)5.1.2 Primary Authority Arrangement with Slough Borough Council

RECC continued to make use of its ‘Primary Authority’ arrangement with Slough Borough Council (SBC) in 2016. According to this SBC provides RECC and our members with dedicated advice on a range of different consumer protection issues; and checks the accuracy of our guidance and model documents so that Code members can rely on them. Primary Authority arrangments are overseen by the Better Regulation Development Office, part of the Department of Business, Innovation and Skills. More details are available here: www.gov.uk/government/organisations/better-regulation-delivery-office

5.1.3 Quarterly newsletter

RECC continued to publish a quarterly newsletter in 2016. The newsletter provides Code members with an easy-to-read update of developments with the Code and the wider sector. It continues to be very well-received. The 2016 editions of the newsletter are here:

January: www.recc.org.uk/images/upload/news_154_RECC-Newsletter-January-2016.pdf

July: www.recc.org.uk/images/upload/news_172_RECC-Newsletter-Jul16.pdf

October: www.recc.org.uk/images/upload/news_176_RECC-Newsletter-Oct-2016.pdf

5.1.4 Webinars

During 2016 RECC continued to host training webinars for RECC Members. Transcripts and videos are available in the Members’ Area of the RECC website. Subjects included the following:

5 February: DECC’s changes to the FIT scheme (with Ofgem, MCS and BEIS)

www.recc.org.uk/member/webinars

15 July: Battery storage & solar PV in the home

www.recc.org.uk/member/webinars

5.1.5 Discounted services for RECC members

During the year RECC teamed up with insurance broker Jelf. As a result, RECC members can access tailored public liability, product liability, professional indemnity and employer’s liability insurance. Jelf provides members with access to specialists who understand the renewables sector and who can provide competitive rates of insurance cover.

During the year RECC also teamed up with legal services provider, LawBite. As a result, RECC members can access fast expert advice at competitive rates as well as easy-to-understand documents (such as contracts, terms and conditions &c). They also provide a free company legal health check.

These two discounted services are in addition to the discount already in place with the Which? Trusted Trader scheme. Full details are available in the Members’ Area of the RECC website: www.recc.org.uk/member/jelf , www.recc.org.uk/member/lawbite and www.recc.org.uk/member/which. (Please note that you will need to log in to the Members’ Area to access them. If you are not a member, contact RECC for details.)5.1.6 RECC guidance and model documents

RECC has improved its suite of guidance and model documents for members during the year. Members find this resource very useful: many adapt the model documents for their own use, which are legally sound, up-to-date and appropriate for the sector. They can be found in the Members’ section of the RECC website: www.recc.org.uk/member.

Guidance covers the Consumer Rights Act 2015, the Consumer Contracts Regulations 2013, the Alternative Dispute Resolution Regulations 2015, performance prediction assumptions and dealing with vulnerable consumers. Model documets include a model contract, a model installer warranty, a model cancellation form, both for companies who do sell in the home, or by distance, and for companies who do not sell in the home, or by distance, a model express request form (for companies who do sell in the home, or by distance, a model dispute resolution process and a model complaints log.

Specifically tailored for solar PV, solar thermal, heat pumps and biomass boilers there are individual model proposal letters, model performance estimates and model quotations and orders, as well as bespoke guidance on performance presentation and preparing consumer proposals.

6. Monitoring compliance with the Code

RECC uses a variety of tools to monitor compliance with the Code and Bye-Laws. These are set out in the Monitoring Strategy agreed with CTSI in 2014. In line with this RECC:

- carries out extensive due diligence checks on all new applicants against a series of important legal undertakings;

- checks that all new applicants are able to demonstrate full compliance with the Code;

- carries out additional desk-based spot checks on at least 1 in 5 applicants;

- undertakes an in-depth, on-site and desk-based Compliance Audit Programme;

- operates a Mystery Shopping Programme;

- analyses Consumer Satisfaction Survey (CSS) questionnaires, online and in hard copy;

- liaises closely with other enforcement bodies including Trading Standards departments, Advertising Standards Authrority and Companies Investigation Branch; and

- liaises closely with consumer-facing bodies including Age UK, Which? and Citizens Advice.

During 2016 RECC worked hard to implement the Monitoring Strategy in line with CTSI’s core criteria. The Monitoring Strategy was scrutinised and approved by CTSI including by its statistician in 2014. You can find full details here: www.recc.org.uk/monitoring/monitoring-strategy.

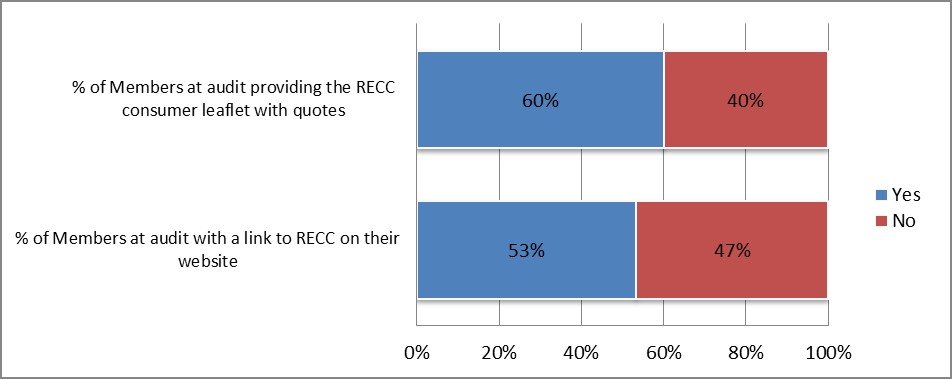

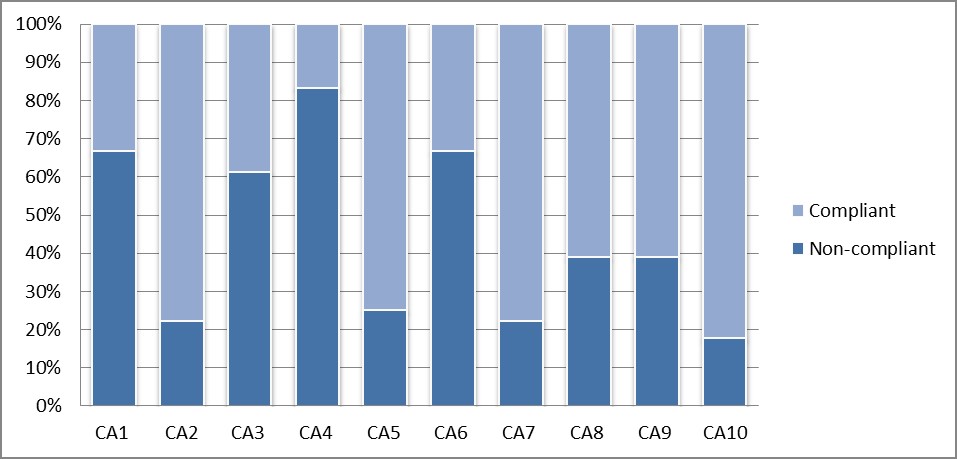

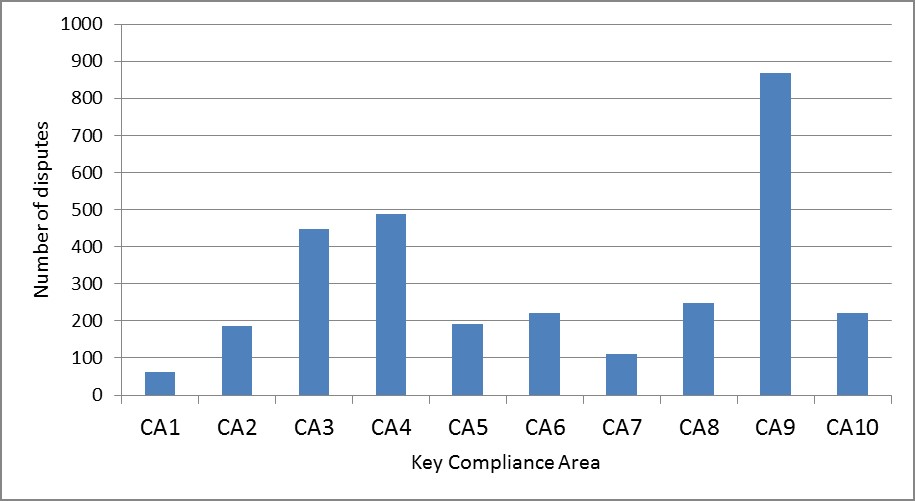

The ten key Compliance Areas (CAs) RECC has adopted are set out in Figure 6.1 below. On the basis of these we are able to analyse and report consistently across our monitoring activities and in this way we can identify the key areas of consumer detriment. They are shaded to show their relative priority.

Figure 6.1 Key Compliance Areas with associated performance measures

CA1: Awareness of consumer protection / RECC (including staff training)

- % of members at audit providing consumer leaflet with quotes

- % of total number of CSS questionnaires returned in which consumers said they had been made aware of RECC

- % of members at audit with link to RECC on their website

- number of members completing RECC online training.

CA2: Microgeneration Certification Scheme (MCS)

- total number and % of disputes received and referred on to MCS Certification Bodies (CBs)

- % of CSS responders indicating receipt of MCS handover documents within 10 days

- % of members in current audit round found compliant on questions relating to MCS

- % of members at audit who are MCS-certified for the relevant technologies.

CA3: Marketing and selling

- % of CSS responders satisfied with how the system was sold

- % of members in current audit round found compliant on questions relating to marketing and selling

- number and % of disputes registered that relate to marketing and selling

CA4: Estimates/quotes, particularly performance estimates and financial incentive

- % of CSS responders indicating sufficient pre-contractual information was provided

- % of members in current audit round found compliant on questions relating to estimates/quotes &c.

- number and % of disputes registered that relate to estimates etc

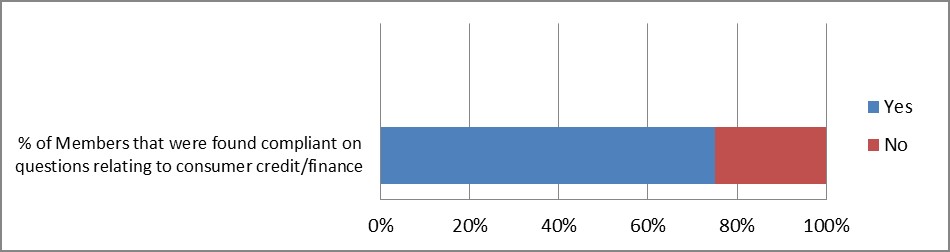

CA5: Finance agreements

- % of members in current audit round found compliant on questions relating to consumer credit / finance agreements

- % of CSS responders indicating that they took finance who consider they were given adequate information and documentation

- number and % of disputes registered relating to finance agreements with members.

CA6: Contracts and cancellation rights

- % of members in current audit round found compliant on questions relating to contracts and/or cancellation rights

- % of CSS responders indicating no concerns about the contract

- number and % of disputes registered that relate to contractual issues and/or cancellation rights.

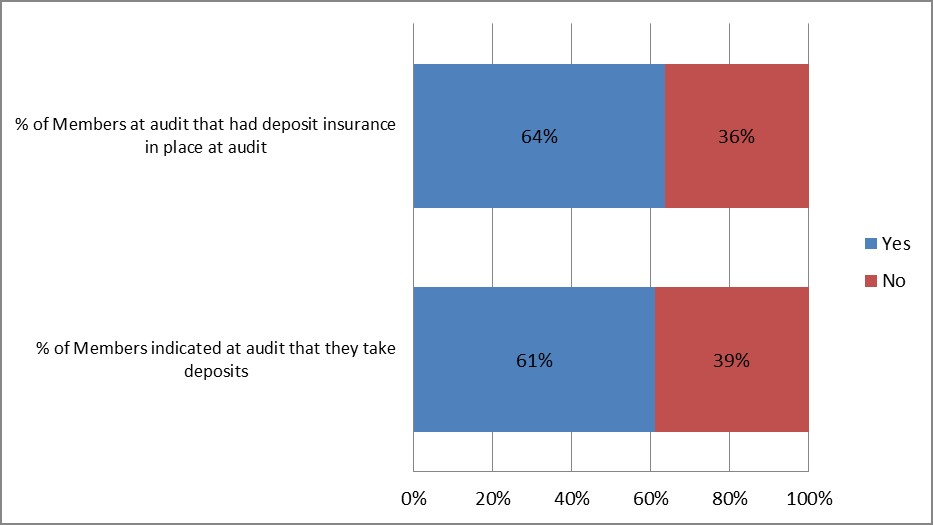

CA7: Taking and protection of deposits and advanced payments

- % of members audited with deposit insurance in place and % of members audited with deposit insurance in place by the end of the audit process

- % of CSS respondents indicating they paid a deposit who state they were provided with deposit insurance details

- number and % of disputes registered that relate to deposits

CA8: Completing the installation

- % of consumers completing CSS questionnaires satisfied with the system they have installed

- number and % of disputes registered that relate to completing the installation

CA9: After –sales (guarantees, workmanship warranties and warranty protection, after sales support: customer service)

- % of CSS respondents indicating they were provided with at least a 2-year workmanship warranty

- % of CSS respondents indicating they were provided with warranty insurance

- % of members in current audit round found compliant on questions relating to after-sales issues

- number and % of disputes registered that relate to after-sales issues.

CA10: Complaints numbers, handling, procedures

- % of CSS respondents indicating they were informed about a disputes procedure

- % of CSS respondents indicating they made a complaint to the member and were satisfied with its handling

- % of members audited who fail on questions relating to disputes-handling

- number of disputes received by RECC

- number of disputes received by category (feedback/referred on/for RECC)

- number of disputes received by issue

- number of disputes received by technology

- number of disputes received as % of total (domestic) installations carried out

- % of disputes resolved by RECC dispute resolution case workers

- breakdown of types of resolution brokered by RECC disputes handlers

- length of time taken in weeks to resolve disputes

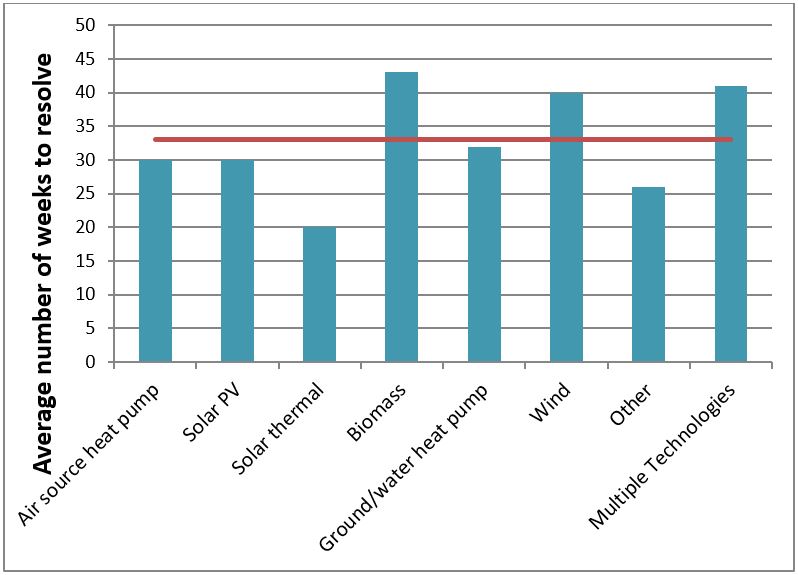

- length of time taken in weeks to resolve disputes by technology

- % of disputes resolved by means of independent arbitration.

6.1 Monitoring applicants

The first rung of the Monitoring Strategy is the compliance check that all applicants are required to complete to demonstrate that they are in a position to comply fully with the Code. All Directors are also required to make a number of very important declarations relating to the trading and solvency history of the company, their past behaviour and that of senior staff and close family members.

A copy of the application form, with declarations, and the compliance check is available on-line on the RECC website and can be downloaded from the following link: www.recc.org.uk/pdf/application-form.pdf.

RECC’s extensive due diligence of all applications it receives involves checking the veracity of all the declarations that the Directors have provided. If the applicant is unable to make any of the required declarations the application will be passed to an independent auditor for a more detailed spot check. The auditor will ask to see administrators’ reports, Companies House records, County Court records and any other relevant sources. If a Director is found to have made a false declaration the application is likely to be referred to the independent Applications Panel.

The due diligence also involves scrutinising applicants’ compliance checks and the documentation submitted as evidence that they have systems in place to comply with the Code and Bye-Laws. If the applicant is not in a position to comply with the Code for any reason it will be passed to an independent auditor for a more detailed spot check.

In addition, as a control, independent auditors will spot-check a random selection of applicants even if their application indicates full compliance and they have made all the required declarations. The compliance check is a documents-based audit of the contract, the quotation, the workmanship warranty, the cancellation form, and a company’s website and other promotional materials. Auditors also check the arrangements for deposit and warranty insurance. As a result of these checks applicants may be required to make changes to their procedures and documents before being admitted to the Code. For example, they will have been required to:- change their advertising and marketing materials;

- adopt the model contract or change their contract terms; and/or

- register with an insurance provider.

During 2016 340 applicants completed compliance checks online and submitted documentation. RECC further spot-checked the compliance status of 20 of these applicants (6 per cent). Of these 20, 8 were referred to the independent Applications Panel for a decision on whether they should be admitted to the Code (40 per cent of those spot-checked, just under 2 per cent of all applicants).

6.1.1 Applications Panel decisions

RECC membership is dependent on applicants obtaining a clean bill of health and so applicants will not be admitted to the Code until any non–conformities or anomalies have been fully addressed. Where a business is unable or unwilling to address these, or where RECC considers that one or more of the Circumstances for refusing Membership may have been met, RECC will refer the application to the independent Applications Panel for a decision. The ‘Circumstances for refusing Membership’ are set out on the RECC website: https://www.recc.org.uk/join/circumstances-for-refusing . The Applications Panel can decide that an application should be:

- accepted, without conditions;

- accepted with conditions e.g. subject to special monitoring;

- accepted on a temporary basis; or

- rejected.

During 2016 the independent Applications Panel met 8 times and considered 8 applications. Of these 8 applications 6 were rejected while 1 was accepted on a temporary basis and 1 withdrew from the process. (See Figure 6.2 for more details of these.) Applicants that are rejected are permitted to reapply for membership, sometimes after a period has elapsed. Re-applications are likely to be referred directly to the independent Applications Panel for a decision.

Keith Richards was Chair of the independent Applications Panel until July 2016 when he was appointed as Chair of the independent Non-Compliance Panel to replace Mary Symes. Sarah Chambers was appointed as Chair of the independent Applications Panel in July 2016, with five other members in the pool from which each Panel is drawn. In 2016 these were: Bryn Aldridge, Nina Dutta, Gretel Jones, Alastair Keir, Michelle Peters (until July 2016) and Fiona Tittensor. Andrew McIlwraith, Michael Thompson and Grace Blackwood (from July 2016) provided the independent secretariat services to the indpendent Applications Panel.

Figure 6.2 Summary of Applications Panel activity in 2016

| Number of Applications Panel meetings held | 8 |

| Number of applications considered | 8 |

| Number of applications accepted without conditions | 0 |

| Number of applications accepted on a temporary basis | 1 |

Of which:

| 0 1 0 |

| Number of applications rejected | 6 |

| Number of applicants withdrew during the process | 1 |

Temporary members

| Number of temporary members | 11 |

Of which:

|

0 6 1 0 1 3 |

6.2 Carrying out compliance audit site visits

As a condition of membership, RECC members are required to co-operate with the Monitoring Strategy agreed with CTSI in 2014.

The audit site visit is a comprehensive and robust on-site inspection of a member’s business and is an important element of the Monitoring Strategy. The audit site visit can take up to a whole day depending on the complexity of the member’s business model and the size of its operations. RECC’s audit programme is designed to be both:

- risk-based, that is RECC focusses its monitoring resources where the potential risk of consumer detriment to consumers and/or non-compliance is highest: the higher the risk, the more intensive the level of monitoring will be; and

- comprehensive, seeking to ensure that all members’ compliance with all key elements of the Code is monitored at regular intervals.

A sample of members is drawn up before each audit round. The sample consists of members selected in line with the level of associated risk. The sampling method is set out in more detail here:

www.recc.org.uk/pdf/process-for-selecting-members-for-audit.pdf.

These audit site visits are carried out by independent auditors based around the country. They use a questionnaire which closley reflects the provisions of the Code and Bye-Laws. The auditors’ skills encompass expertise in consumer protection, quality management and systems audit. RECC revises the questionnaire before every audit round to take on board any Code or Bye-Law changes, lessons learned from previous audit rounds, legal or regulatory changes and feedback from members. The audit questionnaire is available in the Members’ Area of the RECC’s website in a version that includes detailed guidance for members as to what auditors will be looking for, here: www.recc.org.uk/member/audit.

During the audit site visit the auditor identifies with the member any areas of non-compliance and together they complete the audit questionnaire. The auditor then leaves a copy of the completed questionnaire for the members to check for factual accuracy. The auditor then submits the questionnaire to RECC to moderate and score. The member is informed of the results of the audit including any areas of non-conformity and the actions required to resolve them. If appropriate, Members are requested to submit a response in order to reach full compliance within a timeframe. If a member appears unwilling or unable to address any areas of non-compliance, it may be referred to the Compliance Team who will decide how it should be addressed.

6.2.1 Results for 2016 audit site visits

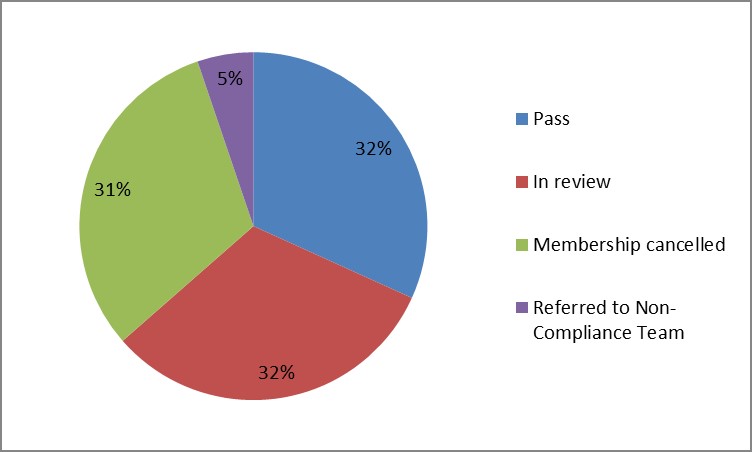

RECC selected 40 members for audit site visits in 2016. Members were selected in line with the procedure described above. Following screening, 19 audit site visits were carried out and completed over the course of the year. After the visit members were provided with the results and a timeframe to respond to any outstanding issues.

In line with the Monitoring Strategy, passing or failing the audit is a reflection of how the member has performed on each key Compliance Area (see page 16 for a list of key Compliance Areas). To pass the audit overall members need to:

- demonstrate compliance in all 7 high priority areas; and

- demonstrate compliance in at least 2 of the three medium priority areas.

On this basis members need to demonstrate around 95% compliance during the visit if they are to pass the audit at the outset.

Figure 6.4 below shows a snapshot of the status of the audits at the end of 2016. Six members had satisfied the RECC Executive of compliance and passed the audit. Where a member does not provide an adequate response or if there are still significant areas of concern after the allotted follow up period, these members are referred to the Compliance Team. In total, 1 company has been referred to the Compliance Team for further consideration and appropriate action. Six companies cancelled their membership or had their membership lapsed by the RECC Executive during the period they were being audited. The scores from each audit ranged from 30 as the lowest score and 112 as the highest score achieved.

Fig 6.4 Status of 2016 compliance audit site visits

As part of the Monitoring Strategy, RECC collects certain performance measures in line with the key Compliance Areas. The charts below show these statistics.

Fig 6.5 Performance measures relating to Code promotion.

Fig 6.6 Performance measures relating to Finance Agreements

Fig 6.7 Performance measures relating to Deposit protection

Figure 6.8 below shows the principal areas of non-compliance in the 2016 audit round. These are shown against the key Compliance Areas (CAs). The most frequent area of non-compliance was the provision of pre-contractual information to consumers (CA4). This is of concern as important information should always be made available before contract agreement and the critical nature of this is recognised in law in the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013 (the CCRs) and in the Consumer Rights Act 2015. In addition to the model documents available to members free of charge, RECC conducted a series of training webinars on this important topic. There is also in-depth detailed guidance on the presentation of this information available for Members on the RECC website.

Contracts and cancellation rights (CA6) and awareness of consumer protection (CA1) were another areas of frequent non-compliance. The Consumer Rights Act 2015 represented an important change in consumer protection legislation in the UK, implementing important new consumer rights. This legislation also has important implications for marketing and selling (CA3); frequently an area of non-compliance at audit. RECC provided guidance and several webinars on the changes to assist members to comply with the new legislation (see page 13 for more details on this).Fig 6.8 Areas of non-compliance in 2016 audit site visits by key Compliance Area

At an individual member level, monitoring enables RECC to pinpoint areas where a member needs to improve and to assist them to achieve compliance. It also enables RECC to identify instances where disciplinary action may be required. Following the audit site visit the member receives a copy of the completed audit questionnaire and a follow-up letter setting out any areas of non-compliance where it is required to take remedial action. The member must submit documentation and evidence to show that it has addressed these areas. The Compliance Team will review any issues that remain outstanding after the final deadline.

During 2016 15 independent auditors carried out compliance audits on behalf of RECC:

Independent auditors

| Virginia Barstow | Yvonne McGivern |

| Hamish Bell | Colin Meek |

| Sue Bloomfield | Carole Pitkeathley |

| Clare Carden | Jackie Robinson |

| Fiona Flynn | Geoff Stow |

| Steve Gillon | Fiona Tittensor |

| Louise David | Paul Voysey |

| Yousouf Jhugroo |

6.3 Mystery shopping

RECC conducts targeted mystery shopping exercises with a view to checking the level of compliance of members considered to pose a high risk of consumer detriment. RECC has a team of mystery shoppers spread throughout the country who assist us by carrying out such mystery shopping exercises.

RECC members are selected for mystery shopping on the recommendation of auditors, as a result of disputes or other intelligence received, or because members have exhibited a high risk of non-compliance in some other way. The principal focus of this exercise is to monitor selling techniques and pre-contractual information provided by members.

Mystery shoppers complete RECC’s bespoke evaluation forms sat all stages of their contact with the member. RECC reviews the results and then decides what follow-up action is appropriate.

Where the msytery shopper identifies non-compliant behaviours, RECC notifies the member and requires them to address the issues. Where it is evident that the member is unwilling to co-operate by taking remedial action, RECC refers the member to the Compliance Team.

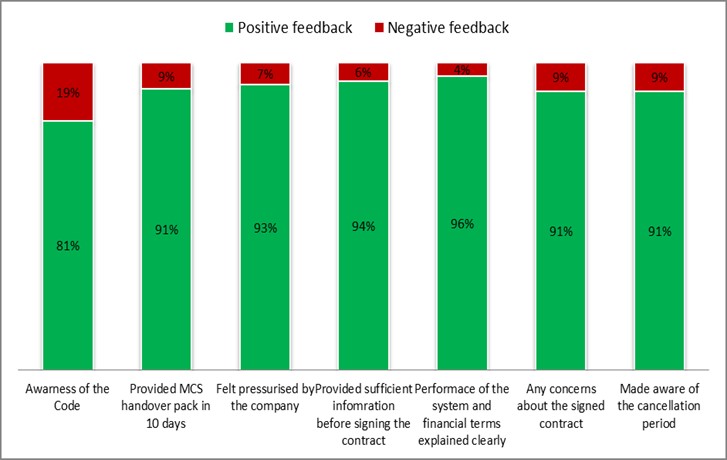

6.4 Surveying consumer satisfaction

RECC monitors how satisfied consumers are with the service they have received and also checks that member are complying with the Code. Consumers may log feedback online using the ‘Rate your installer’ tool on the RECC website. Alternatively, consumers may return hard copy Customer Satisfaction Survey (CSS) questionnaires directly to us. For example, all consumers whose installations are registered under the DAWWI insurance scheme receive a CSS questionnaire with their policy documentation. In this way consumers are able to provide feedback on the experience they have had with members. We analyse all feedback posted online provided in returned questionnaires.

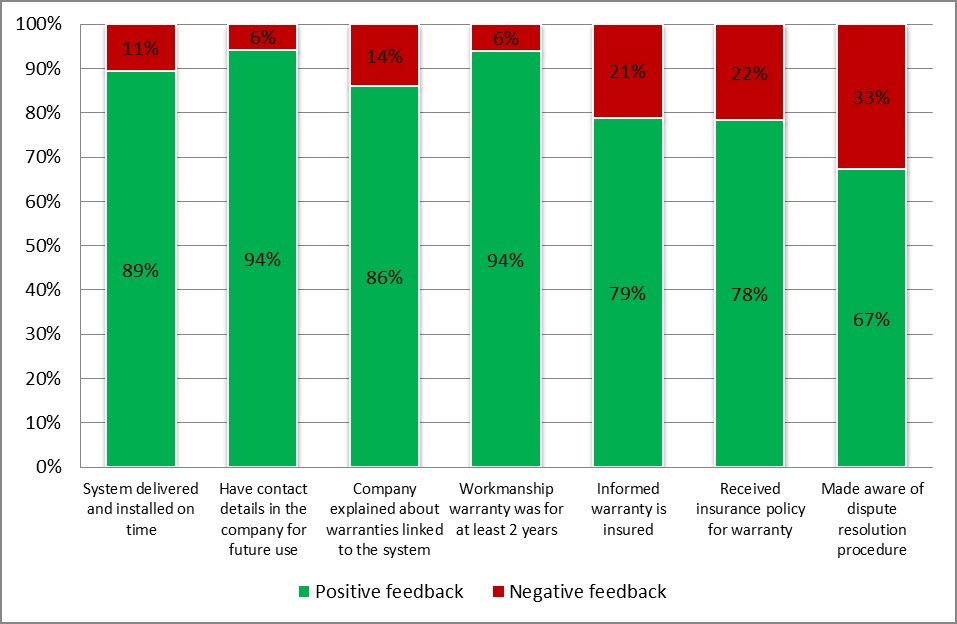

The charts show that the majority of consumers who provided feedback were positive about their experience with RECC members:

- 87% of consumers said they were provided with sufficient information about the system before signing a contract;

- 92% said that the performance of the system was clearly explained to them as well as what this meant in financial terms;

- 87% said they were made aware of their cancellation rights.

Of those consumers who did not give such positive feedback:

- 33% said they were not made aware of a dispute resolution procedure;

- 25% said they were not made aware of the Consumer Code before they signed the contract.

Fig 6.9 Consumer satisfaction responses by question 2016

Fig 6.10 Consumer satisfaction responses by question 2016 (con’t)

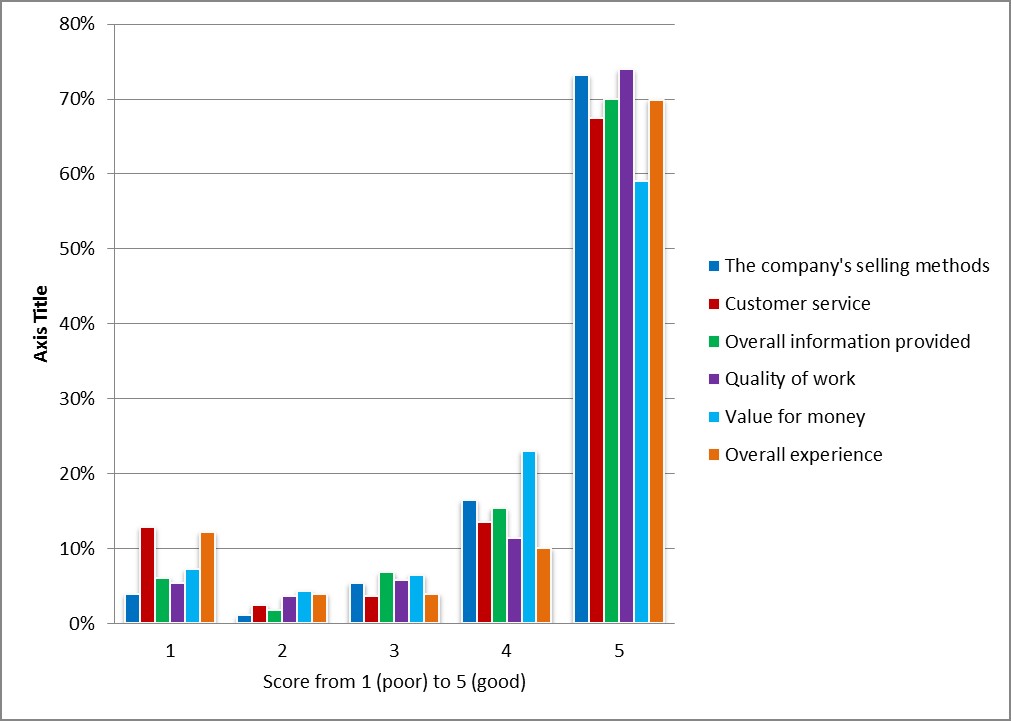

Feedback received from hard copy questionnaires about the way the system had been installed and about the way in which the system was sold to them overall show that:

The company’s selling methods:

- 89% of consumers rated it as 5/5 or 9/10 indicating they were very satisfied or satisfied;

- 11% of consumers rated it as 3/5 or below.

Customer service:

- 82% of consumers rated it as 5/5 or 4/5 indicating they were very satisfied or satisfied;

- 18% of consumers rated it as 3/5 or below.

Overall information provided:

- 85% of consumers rated it as 5/5 or 4/5 indicating they were very satisfied or satisfied;

- 15% of consumers rated it as 3/5 or below.

Quality of work:

- 85% of consumers rated it as 5/5 or 4/5 indicating they were very satisfied or satisfied;

- 15% of consumers rated it as 3/5 or below.

Value for money:

- 82% of consumers rated it as 5/5 or 4/5 indicating they were very satisfied or satisfied;

- 18% of consumers rated it as 3/5 or below.

Overall experience:

- 80% of consumers rated it as 5/5 or 4/5 indicating they were very satisfied or satisfied;

- 20% of consumers rated it as 3/5 or below.

The feedback RECC received in 2016, both online and through hard copy questionnaires, gave us an insight into RECC members’ business models. Of the consumers who provided feedback:

- 51% said they had signed a contract during the sales visit;

- 8% said they had bought their system with finance5, of which 81% said they had been given adequate information and documentation regarding the finance agreement;

- 74% said they had paid a deposit as part of the contract, of which 68% confirmed that they had received an insurance policy which protected their deposit.

Fig 6.11 Satisfaction rates with system installation and company selling methods

7. Enforcing compliance with the Code

In 2016 RECC’s Compliance Team continued to investigate suspected breaches of the Code and/or the Bye-Laws. RECC may investigate evidence of a potential breach from a wide range of sources of information including:

- disputes and feedback;

- an analysis of arbitration outcomes;

- audit site visit reports;

- compliance checks and spot checks;

- the results of Consumer Satisfaction Surveys;

- mystery shopping reports;

- intelligence from Citizens Advice, Trading Standards Departments, the Advertising Standards Authority, Courts or tribunals, Financial Conduct Authority, Companies Investigation Branch, Scam Busters;

- publicly available information including media reports; and/or

- the MCS Administrator or MCS Certification Bodies.

The Compliance Team compiles evidence from a range of these sources. Where there is evidence of breach, the Team sends it to the member who is invited to respond providing the necessary clarification and explanation. This is the start of the disciplinary procedure. In line with this in 2016 the Compliance Team wrote to 42 members inviting them to respond to evidence of potential breaches.

7.1 Invoking non-compliance action

Where a member is unable to provide the evidence required to demonstrate full compliance with the Code and/or its Bye-Laws, or where the initial evidence received suggests a serious and/or repeated breach of the Code, RECC may formally invoke non-compliance action. In line with the Bye-Laws RECC may impose a number of sanctions on the member once the non-compliance action has been invoked, including inviting the member to sign a Consent Order agreeing, for example, not to breach the Code and/ or Bye-Laws again, imposing a Period of Enhanced Monitoring, or convening a Hearing of the Non-Compliance Panel. In line with this, in 2016 RECC invoked non-compliance action against 22 members, 5 of whom agreed Consent Orders with RECC. You can find full details of the Consent Orders here:

www.recc.org.uk/scheme/non-compliance-action/consent-orders .

Of the 22 members whom RECC formally invoked non-compliance action against, RECC imposed the following sanctions during 2016:

| Consent Orders | 5 |

| Terminations for Non-Compliance (without Non-Compliance Panel referral) | 10 |

| Referrals to the Non-Compliance Panel | 2 |

| Period of Enhanced Monitoring | 5 |

7.2 Convening the independent Non-Compliance Panel

If further evidence of potential breaches is received, or if a member breaches a Consent Order, RECC may convene an independent Non-Compliance Panel (NCP) Hearing to consider the matter. In 2016 the NCP held 2 independent Hearings. The outcomes are summarised in Figure 7.1, below. You can find full details of the Determinations here: www.recc.org.uk/scheme/non-compliance-panel/hearings.

The governance of the NCP is set out in full in the RECC Bye-Laws and in the NCP Rules. All NCP members are independent of the RECC Executive and a majority, including the Chairman, is independent of the sector. The Chair of the NCP until July 2016 was Mary Symes. She was replaced by Keith Richards at that time. There was a pool of six other NCP members from which each Panel is drawn. They were: Amanda McIntyre, Sally Oakley, Michelle Peters (from July 2016), Elizabeth Stallibrass, Jim Thornycroft, Helen White and Alan Wilson.

Andrew McIlwraith, Michael Thompson and Grace Blackwood (from July 2016) provided the independent secretariat services to the Non-Compliance Panel. Two Main provided the recording and transcription service and Eversheds provided the rooms in which the Hearings were held.

Figure 7.1 Summary of independent Non-Compliance Panel activity in 2017

Non Compliance Panel

| Number of independent NCP Hearings held | 2 |

| Number of members invited to attend Hearings | 2 |

NCP Determinations:

| 1 1 0 0 |

| No of members attending NCP Hearing for second time | 1 |

NCP cost awards

| Number of NCP Hearings in which NCP awarded costs to RECC | 2 |

| Number of NCP Hearings in which NCP awarded costs to Member | 0 |

| Amount of costs NCP awarded to RECC | £4,089 £76,331 |

| Average costs of each NCP Hearing | £40,210 |

7.3 Convening the independent Appeals Panel

The independent Appeals Panel is ad hoc and is comprised of members of the pools of the other two panels. A member serving on the Appeals Panel may not previously have considered the appellant member in any other forum. The governance of the Appeals Panel is set out in full in the RECC Bye-Laws and in the Appeals Panel Rules. In 2016 two members appealed against an NCP Determination. In both these cases an Appeals Panel Hearing was convened to hear the appeal.

Keith Richards was the Chairman of the Appeals Panel, and the Appeals Panel upheld the NCP Determination. This is summarised in Figure 7.2, below. You can find full details of the Appeals Panel Determinations here: www.recc.org.uk/scheme/appeals-panel/determinations .

Fig 7.2 Summary of independent Appeals Panel activity in 2016

Appeals Panel

| NCP Determinations referred to independent Appeals Panel | 2 |

| Number of Appeals Panel Hearings held | 2 |

Of which the Appeals Panel:

| 1 1 |

Appeals Panel cost awards

| Number of Appeals Panel Hearings in which Panel awarded costs to RECC in full | 1 |

| Number of Appeals Panel Hearings in which Panel awarded costs to RECC in part | 1 |

| Amount of costs Appeals Panel awarded to RECC | £67,529 £3,970 |

| Average costs of each Appeals Panel Hearing | £35,749 |

8. Resolving consumer disputes with members

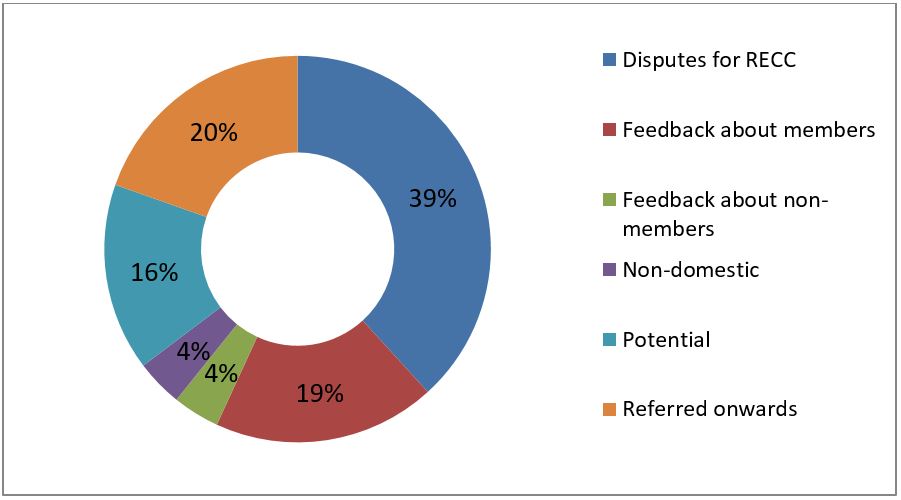

In 2016 RECC received 1,143 complaints and feedback. Of these, 39% were for RECC to handle through the dispute resolution process, while 22% were feedback disputes in which consumers were not seeking redress but simply wished to register their dissatisfaction. Disputes about non-members were also recorded as feedback and accounted for 4% of the total feedback disputes. In these cases, RECC advises the consumer to contact their local Citizen’s Advice. Where the non-member has sub-contracted work to a RECC member, RECC holds the member responsible and will seek to resolve the dispute through them.

8.1 Categorising consumer disputes

The disputes registered in 2016 were in respect of 436 different RECC members. 281 of these members had just one dispute registered against them; the reminder had more than one with 5 having 20 or more. In some cases RECC is not the appropriate body to handle the dispute registered. For example, disputes predominantly or partly about technical issues made up 20% of all disputes registered in 2016. These disputes were passed to the member’s MCS Certification Body; however some may be passed back to RECC later if there are any outstanding issues relating to the Consumer Code.

It is important to note that these figures do not reflect the total consumer detriment since they exclude those disputes reported to other bodies and those that went unreported.

Fig 8.1 Total number of disputes registered with RECC by year

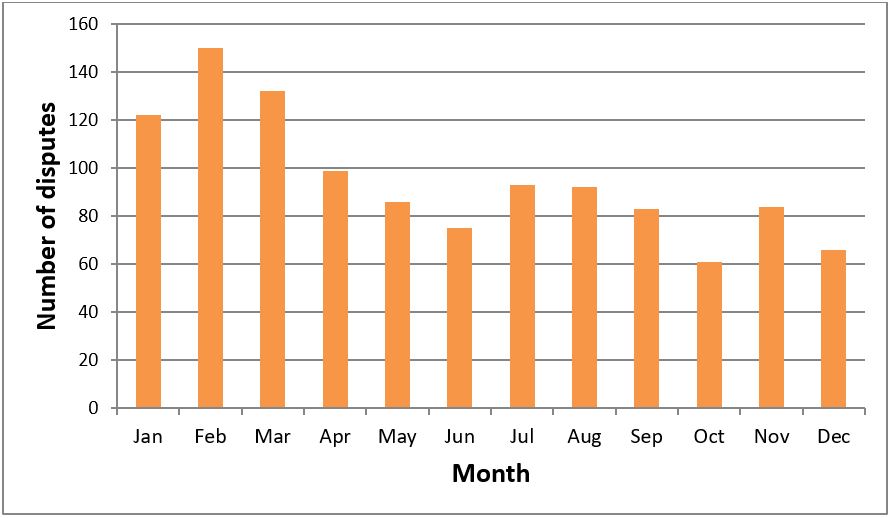

Fig 8.2 Total number of disputes registered with RECC by month in 2016

Fig 8.3 Disputes registered by RECC in 2016 by category

Fig 8.4 Disputes registered by RECC in 2016 by technology

In 2016, RECC received a number of disputes about new technologies namely gas absorption heat pumps, solar assisted heat pumps and battery storage units. The majority of these concerned battery storage units where RECC received a total of 95 disputes. Consumers generally sign a contract for a solar PV system and a battery storage or a contract for a battery storage where there is an existing solar PV system. Disputes about battery storage are generally about:

- mis-selling (incorrect information about the financial benefits, e.g. savings, incorrect payback period and claims that the battery will boost the performance of solar pv system and feed in tariff income) or;

- technical issues (manufacturer’s faults with the product or the product affecting the performance of the solar pv system)

Fig 8.5 Disputes registered by RECC in 2016 by technology

Technology |

Disputes registered by RECC in 2016 |

Disputes registered by RECC in 2015 |

Variance 2016 over 2015 (%) |

ASHP |

108 |

117 |

-9 |

Biomass |

113 |

171 |

-58 |

GSHP |

28 |

30 |

-2 |

Micro CHP |

0 |

1 |

-1 |

Other (non-MCS) |

72 |

39 |

+ 33 |

Solar PV |

764 |

948 |

-184 |

Solar thermal |

64 |

49 |

+ 15 |

Fig 8.6 Disputes registered by technology as a % of all domestic installations

Technology |

Disputes registered with RECC |

Total domestic installations |

Percentage |

ASHP |

108 |

5,135 |

2.1 |

Biomass |

113 |

962 |

11.7 |

GSHP |

28 |

1,236 |

2.3 |

Solar PV |

764 |

73,306 |

1.0 |

Solar thermal |

64 |

660 |

9.7 |

Fig 8.7 Solar PV disputes registered with RECC by year as a % of all domestic solar PV installations

Year |

Solar PV disputes registered with RECC | Total domestic solar PV installations | Total domestic solar PV installed capacity | Percentage |

2016 |

764 | 73,306 | 288 MW | 1.0 |

2015 |

948 | 142,250 | 517 MW | 0.7 |

2014 |

754 | 110,120 | 406 MW | 0.7 |

2013 |

937 | 85,755 | 313 MW | 1.1 |

2012 |

1,051 | 201,178 | 687 MW | 0.5 |

2011 |

439 | 124,385 | 381 MW | 0.4 |

Fig 8.8 Solar PV disputes registered with RECC by year as a % of all domestic solar PV installations

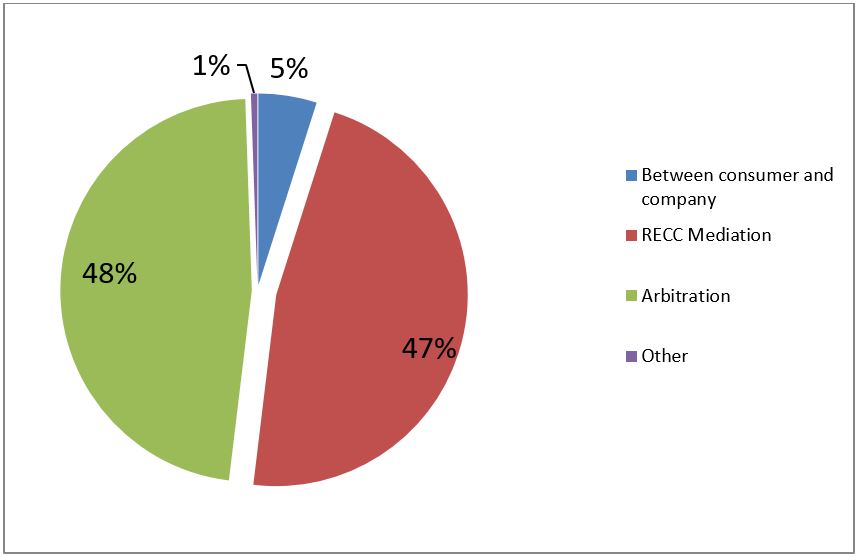

8.2 Resolving consumer disputes by means

RECC’s team of 10 experienced dispute resolution caseworkers work very hard to resolve disputes that fall within RECC’s remit. In 2016 our caseworkers were able to resolve 47% of the disputes allocated to them through mediation. A total of £76,936 was recovered for consumers.

Of the 183 disputes which were resolved in 2016 it took an average of 31 weeks to resolve each one. Resolving disputes through mediation took slightly less time at 24 weeks. 51% of disputes took less than 29 weeks to resolve, while 49% took more 29 weeks. Disputes were another organisation was involved such as an MCS certification body, in addition to RECC generally take longer to resolve.

Fig 8.9 Breakdown of means by which disputes were resolved in 2016

Fig 8.10 Length of time taken to resolve disputes in 2016

Fig 8.11 Issues underlying disputes registered by RECC in 2016 by key Compliance Area

Fig 8.12 Key Compliance Areas for disputes

CA1: Awareness of consumer protection / RECC (including staff training)

- Training of staff

- Training of/including RECC in dealings with sub-contractors

- Senior management awareness

- Failure to foster consumer awareness – provision of leaflet, link to Code from member’s website, display of RECC logo

CA2: Microgeneration Certification Scheme (MCS)

- Contracting party is not MCS-certified for technologies they sell/install

- Contracting party is not also the party applying for MCS certificate

- Compliance with MCS standards (regarding documentation such as performance estimates and handover packs, as well as workmanship/technical issues)

- Sub-contracting is not in line with MCS (including having a contract with sub-contractors)

CA3: Marketing and selling

- Misleading advertising and marketing

- Cold-calling/Telephone Preference Service-registered customers

- Sales visits/discounting

- Visits to vulnerable consumers

- Payments for referrals/advertising boards/testimonials

CA4: Estimates/quotes, particularly performance estimates and financial incentive

- Incorrect performance estimates

- Information on Permissions/EPC, responsibility for etc

- Income/savings estimates

- FiTs/RHI information

- Quotes

- Information for vulnerable consumers

- Survey

- Design

CA5: Finance agreements

- Consumer information

- Terms, including cooling off period for finance agreement

- Transparency of member benefits from link with the finance provider, where these are discoverable

CA6: Contracts and cancellation rights

- Fair terms and conditions

- Cancellation period

- Cancellation rights

- Contract change procedures (including recalculation of performance estimate or expected income figures &c)

- Refund of deposit:

- when cancelled inside cancellation period

- when cancelled outside cancellation period

- when post-contract survey shows, or installer finds, problems with contracted system

- Title

- Contractual discrepancies:

- design differs

- failure to provide items (eg monitors) in contract

CA7: Taking and protection of deposits and advanced payments

- Percentage of contract price taken as deposit

- Percentage of contract price taken as advanced payment

- Timing of the taking of advanced payments

- Deposit protection

- Client account (subject to change)

CA8: Completing the installation

- % of consumers completing CSS questionnaires satisfied with the system they have installed

- number and % of disputes registered that relate to completing the installation

CA9: After –sales (guarantees, workmanship warranties and warranty protection, after sales support: customer service)

- Storing goods

- Delivery dates in writing

- Timeliness of installation

- Testing, commissioning and handover

- Company insurance against damage during install

CA10: Disputes numbers, handling, procedures

- Manufacturers guarantees

- Workmanship warranty provision

- Workmanship warranty length

- Warranty protection

- Extended warranties

- Servicing agreements

- After-sales support: customer service, call backs, replies to emails etc.

- Repairs

8.3 Referring consumer disputes to the independent arbitration service

8.3.1 Domestic claims

Where a dispute remains unresolved following RECC’s mediation process a consumer may apply to the independent arbitration service. The service is provided for RECC by IDRS Ltd, part of the Centre for Effective Dispute Resolution (CEDR). If a consumer asks for access to the arbitration service the member must agree. Consumers and members are each required to contribute £100 + VAT to the cost of the service, with RECC contributing the balance. The arbitrator’s award is legally binding and enforceable, and is an alternative to a court judgment. The arbitration service rules can be found here: www.recc.org.uk/pdf/arbitration-service.pdf.

The total amount awarded to domestic consumers at arbitration in 2016 was £396,306 in 62 financial awards made, with the average amount awarded £6,392. (This is based on an average of the 62 cases in which financial awards were made.)

Fig 8.13 Summary of the 87 domestic arbitration awards made in 2016

Outcome |

Number |

Percentage |

Claim dismissed or failed |

22 |

25 |

Claim succeeded in part |

43 |

49 |

Claim succeeded in whole |

22 |

25 |

Total |

87 |

99 |

Member ordered to refund the consumer's registration fee |

63 |

72 |

Consumer ordered to refund the member's registration fee |

11 |

13 |

No costs order made |

13 |

15 |

Total |

87 |

100 |

Outcome |

Number |

Percentage |

Financial award only made |

25 |

29 |

Non-financial award made, e.g. provision of documentation, removal of a system or rectification of damage |

3 |

3 |

Both financial and non-financial award made |

37 |

43 |

No award made |

22 |

25 |

Total |

87 |

100 |

(These percentages have been rounded to the nearest whole number and so may not total 100.)

8.3.2 Micro-business claims

The independent micro-business arbitration scheme is designed for those consumers who do not fall within the definition of domestic consumer but who are close to domestic. For example they could be small farmers, or they could run a small hotel or offer bed and breakfast accommodation. Such consumers do not have access to RECC’s formal consumer dispute resolution procedure, but may proceed directly to the micro-business arbitration service if the company their contract was signed with is a member of RECC.

Consumers and members are each required to contribute £200 + VAT to the cost of the service, with RECC contributing the balance. The arbitrator’s award is legally binding and enforceable, and is an alternative to a court judgment. The maximum amount which can be claimed through the micro-business scheme is £50,000. The rules can be found here: www.recc.org.uk/pdf/arbitration-scheme-for-commercial-disputes.pdf.

The total amount awarded to micro-business consumers in 2016 was £49,363 in 2 financial awards made, with the highest amount awarded £35,998 and the average amount awarded £24,682. (See Figure 8.14, below.)

(To qualify for the independent micro-business arbitration scheme, a micro-business consumer must declare that they have: (i) an annual consumption of (a) electricity of not more than 55,000 kWh; or (b) gas of not more than 200,000 kWh; or (ii) (a) fewer than 10 employees (or their full time equivalent); and (b) an annual turnover or annual balance sheet total not exceeding £1.5 million.)

Fig 8.14 Summary of the 8 micro-business arbitration awards made in 2016

Outcome |

Number |

Percentage |

Claim succeeded in part |

5 |

63 |

Claim succeeded in whole |

0 |

0 |

Claim failed |

2 |

25 |

No award made (jurisdiction issue) |

1 |

13 |

Total |

8 |

101 |

Member ordered to refund the consumer's registration fee |

5 |

63 |

Consumer ordered to refund the member's registration fee |

3 |

38 |

No costs order made |

0 |

0 |

Total |

8 |

101 |

Financial award only made |

1 |

13 |

Both financial and non-financial award made |

1 |

13 |

Non-financial award only made |

3 |

38 |

No award made |

3 |

38 |

Total |

8 |

102 |

(These percentages have been rounded to the nearest whole number and so may not total 100.)

9. Resourcing the RECC team

9.1 RECC team

The RECC team works tirelessly to promote and enforce the Code in a robust and even-handed manner. Between us, we have a wealth of knowledge and experience, with backgrounds in economics, law, trading standards, dispute resolution, customer service, renewable technologies and environmental management. We are always happy to answer questions and provide one-to-one advice on a range of different subjects to consumers and members alike. What makes the team really special is our committment to our members and our consumers.

Operations

Virginia Graham – Chief Executive

Mark Cutler – Head of Operations

Membership

Aida Razgunaite – Membership Manager

Georgia Phetmanh – Membership Assistant (up to 30 November 2016)

Monitoring

Sam Bourn – Monitoring Manager

Compliance

Lorraine Haskell – Panels Liason Manager

Rebecca Robbins – Compliance Manager

Andreea Miu – Compliance Analyst

Dispute resolution

Sarah Rubinson – Dispute Resolution Manager (to 9 September 2016)

Abena Simpey – Dispute Resolution Case Manager (from 1 September 2016)

Boris Eremin – Dispute Resolution Case Worker (from 1 February 2016)

Emily Lynskey – Dispute Resolution Case Worker (to 4 March 2016)

Caroline Thomson – Dispute Resolution Case Worker (from 25 April 2016)

Bernardo Muchado Esteves – Dispute Resolution Case Worker (from 10 October 2016)

Dispute resolution – working externally

Eileen Brennan – Dispute Resolution Case Worker

Jonathan Bullock – Dispute Resolution Case Worker

Anna Hills – Dispute Resolution Case Worker

Annabel Howcroft – Dispute Resolution Case Worker

Caroline Sharpe – Dispute Resolution Case Worker

Camilla Thomas – Dispute Resolution Case Worker

Victoria Thorp – Dispute Resolution Case Worker

9.2 RECC budget

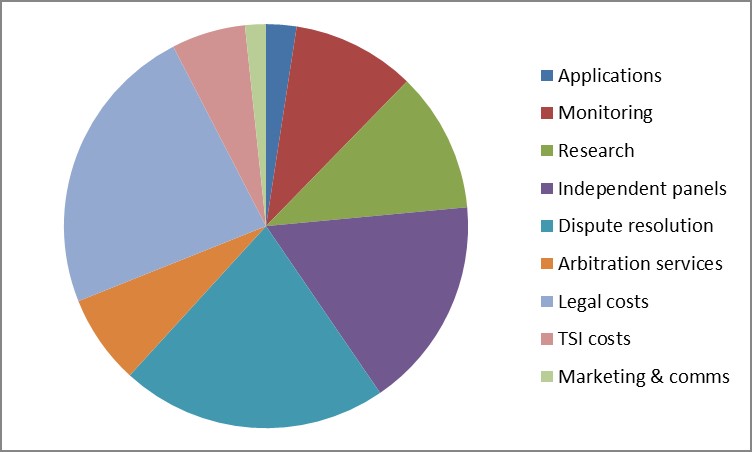

RECC reinvests all its membership fees with a view to continuously improving the services we provide for our members and provide guidance and training to assist our members with compliance. One third of RECC’s expenditure, including staff costs, goes on guidance and training, monitorintoring and enforcing compliance, including independent panels, and dispute resolution. These accounted for over a third of our expenditure, including staff costs. RECC operates on a not-for-profit basis which guarantees that members’ fees are invested directly back into the sector and the Code.

Fig 9.1 Breakdown of RECC’s expenditure in 2016

10. Looking ahead

RECC will continue to engage in the broader strategic discussions taking place in the sector during the years ahead. BEIS and Ofgem have unveiled their strategy for delivering a smart, flexible energy system. This is their response to a joint consultation issued in 2015. Over the next few years domestic consumers will be faced with a range of new products and services including time-of-use tariffs, smart meters and appliances, demand-side management incentives, battery storage and electric vehicles. These developments offer exciting, new opportunities for consumers, but they will require information and guidance if they are fully to exploit what is on offer.

In line with this, many RECC members are already offering battery storage either with new solar PV systems or as a retro-fit for existing systems. This has been a welcome avenue for solar PV installers faced withf major changes to the Feed-In Tariff scheme in 2016, including reduced trariffs and the introduction of banded capacity caps and degression thresholds. RECC has fully embraced the additional benefits on offer to consumers though we remain very concerned at the level of mis-selling being reported to us. Unfortunately some installers appear to be marketing systems very aggressively, with frequent cases of misleading claims and misrepresentation of benefits being made.

To help counteract this, RECC is continuing to work closely with our members, providing as much training and guidance as we can to ensure that consumers are provided with the accurate information they need before they sign a contract. We are also continuing to work closely with manufacturers keen to ensure that their products are not being mis-sold to consumers.

Government has also announced that the domestic Renewable Heat Incentive tariff for heat pumps will increase later in the year. With this in mind MCS has updated and clarified the heat pump standard. It now requires a mandatory performance estimate to be provided before a contract is signed. RECC will continue its work to develop guidance to help consumers to understand the potential and suitability of heat pumps for their heating and hot water needs.

Finally, RECC has played an active part in the discussions leading up to the Each Home Counts Review. It aims to extend high consumer protection standards across the broader energy efficiency sector. RECC will continue to work with all parties to ensure that the existing consumer protection standards in the small-scale renewables sector are not watered down.

28 July 2017.