Insurance Providers

RECC requires members to protect Deposits and Workmanship Warranties.

RECC requires members to insure any deposits they take, together with the workmanship warranties they issue, to protect a consumer against an installer ceasing to trade. Deposit cover and workmanship warranties can come in the form of Insurance Backed Guarantees (IBGs) and should be provided to domestic customers by the installing contractor to ensure the correct Consumer Protection is in place.

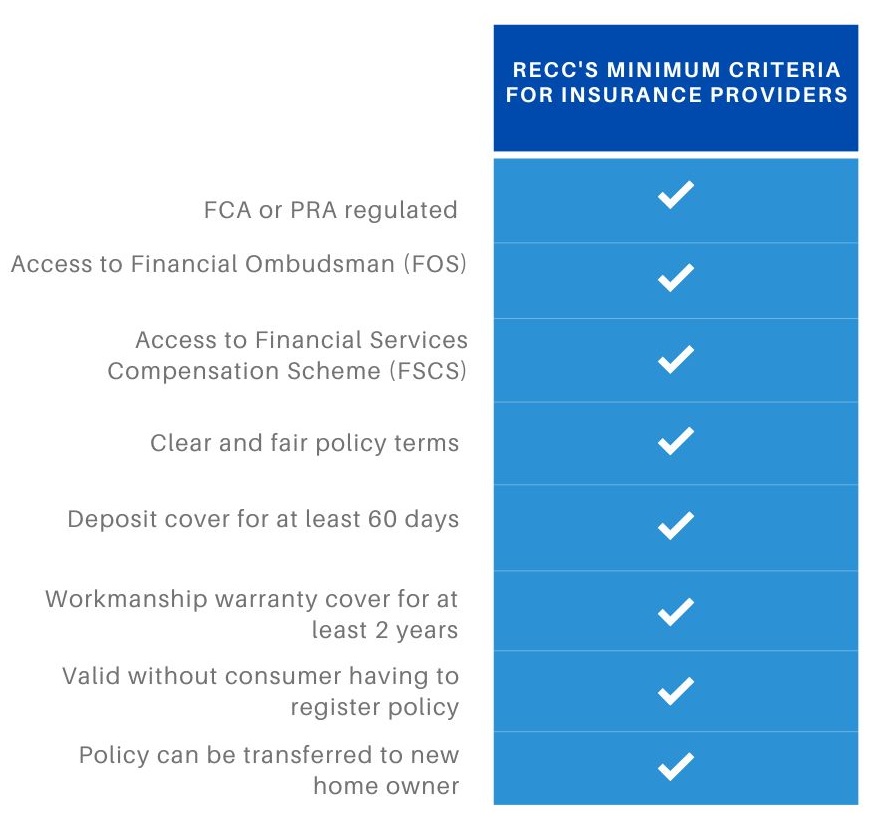

There are a number of insurance providers who offer such products, and which meet RECC’s minimum criteria for this type of cover.

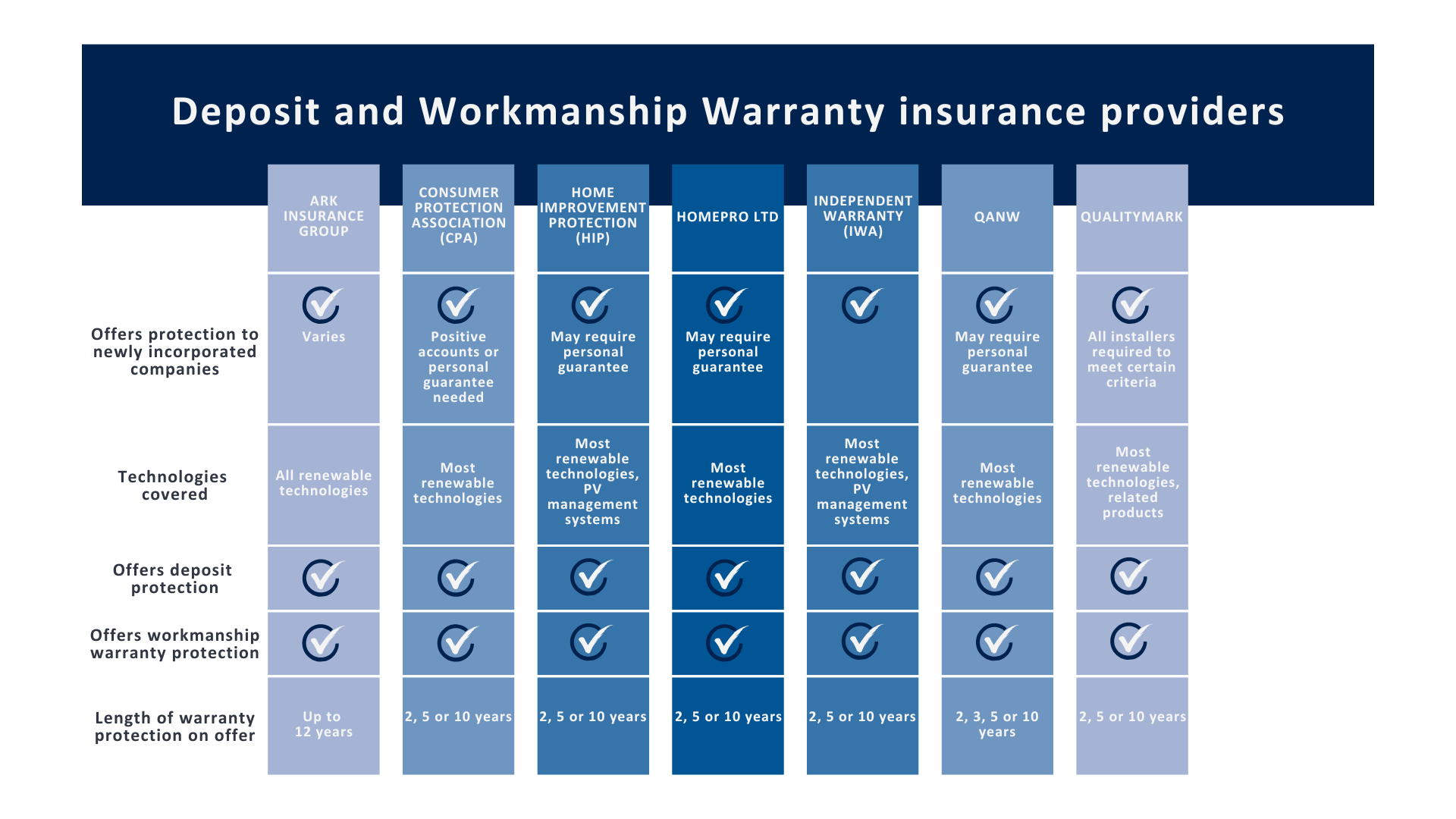

Members can use this table to quickly compare insurance products and find one suitable for their business model.

It is essential that you make yourself aware of the terms and conditions of whichever product you use, in order to check that the cover is adequate, and inform consumers how their deposits, advance payments and workmanship warranties will be protected. More information can also be given directly by each provider directly.

RECC encourages members to shop around.

Please note that Renewable Energy Assurance Ltd (REAL), the company that administers RECC, is not an insurance company. Neither REAL nor RECC derive any benefit, financial or otherwise, from any insurance provider. This information is correct to the best of RECC’s knowledge.

If you are an insurance provider and you would like to appear on this list then please email info@recc.org.uk.