Annual Report 2013

Annual Report 2013 for the Trading Standards Institute

1. Introduction

This annual report has been produced for Trading Standards Institute (TSI). It sets out the principal activities and achievements of the Renewable Energy Consumer Code (RECC) during the calendar year 2013. On 1 April 2013 the Renewable Energy Consumer Code (RECC) received TSI approval under the Consumer Codes Approval Scheme (CCAS). This followed the transfer of responsibility for the CCAS from the Office of Fair Trading (OFT) to TSI on the same date as part of the future consumer landscape reforms. RECC looks forward to a constructive relationship with TSI in the years to come.

2. Contents

- Overviewing membership and the wider sector

- Governing the Code

- Promoting the benefits of the Code

- Monitoring compliance with the Code

- Enforcing compliance with the Code

- Resolving complaints in respect of Code members

- Resourcing the RECC team

- Looking ahead

3. Overviewing membership and the wider sector

RECC covers the small-scale renewable heat and power generating sector. Any business selling, leasing and / or installing small-scale heat and power generators to domestic consumers is eligible to join RECC. Consumers wishing to benefit from Government financial incentives for installing small-scale generation systems must ensure that they agree a contract with an installer certified by the Microgeneration Certification Scheme (MCS). Businesses seeking MCS certification must first be a member of a TSI-approved consumer code.

Generating heat or power in one’s own home represents a very significant investment when compared with most other purchase decisions one makes. Consumers need plenty of time to consider carefully before they decide to sign a contract. They need to have sight of all the relevant documents so they can scrutinise them and compare the offer with others they have received. This is the context within which RECC works tirelessly to ensure the highest standards of protection for consumers buying or leasing small-scale renewable generating systems. In this way, RECC aims to promote the reputation of the sector and thus benefit its members.

Throughout the year consolidation and restructuring of the sector continued, with a large number of businesses ceasing to trade, merging or repositioning themselves as a result of the rapid reduction of the Feed-In Tariff (FIT) rates that took effect on 1 April 2012. RECC membership reduced from 5,500 at the peak in 2012 to 4,500 in 2013 (see chart right). On 12 July 2013 the Government announced the details of the Domestic Renewable Heat Incentive, though it was not to be launched until 2014.

2013s was a very challenging year for RECC. The uncertainty and confusion that surrounded the solar PV tariff rate reduction continued to result in a high degree of consumer detriment, particularly with solar PV installations. Complaint levels remained very high with, on average, 130 new complaints being registered with RECC each month during 2013, the majority about solar PV installations:

- in 2013 1.1% of all domestic solar PV installations were the subject of a complaint registered with RECC (937 out of 85,755 (313 MW));

- in 2012 0.5% of all domestic solar PV installations were the subject of a complaint registered with RECC (1,051 out of a total of 201,178 (687MW));

- in 2011 0.4% of all domestic solar PV installations were the subject of a complaint registered with RECC (439 out of a total of 124,385 (381MW)).

Fig 3.1 RECC Membership by year

Fig 3.2 RECC Membership 2013 by category

(Membership fees correspond to the total number of employees involved in renewable energy activities, including backroom staff and sales representatives, even when these are not directly employed by the company. The membership category is verified during audit.)

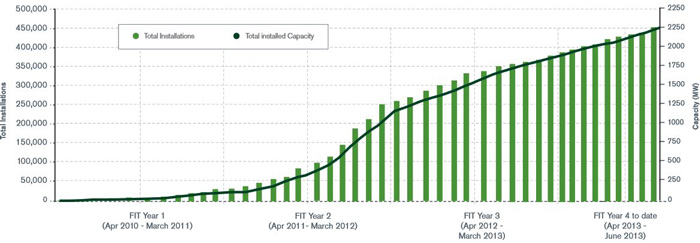

Fig 3.3 Registered FIT installations and Total Installed Capacity between 2010 and 2013

The chart above shows the cumulative growth in the total number of FIT registrations since 10 April 2010, when the scheme started, and 31 December 2013 as well as the Total Installed Capacity over the same period. It shows that there was a marked increase in both during the second half of Year 2; and that the average size of each installation has increased gradually since the scheme started. (Source: Ofgem)

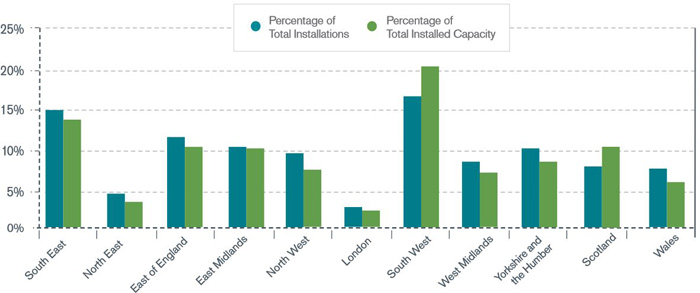

Fig 3.4 Share of registered FIT installations and Total Installed Capacity by region

The chart above shows that the South West accounted for the greatest number of registered FIT installations as well as the greatest amount of Total Installed Capacity between 10 April 2010 and 31 December 2013. The South East accounted for the next highest, with the North East and London the lowest. (Source: Ofgem)

4. Governing the Code

The Code is administered by Renewable Energy Assurance Ltd (REAL) with a Board of Directors, both Executive and Non-Executive. REAL is a wholly-owned subsidiary of Renewable Energy Association (REA), a not-for-profit company, which is the leading trade association in the renewables sector and the Code sponsor. REAL makes no money from administering the Code. All membership fees are used to improve the services we offer our members.

The Code sets out the relationship between RECC members and consumers while the Bye-Laws govern the relationship between RECC and its members. The Board of Directors is responsible for adopting and overseeing the RECC Bye-Laws.

4.1 Updating the Code

The Code is a living document and has to reflect developments in the policy, legal and industry context within which it operates. We are also required to ensure that the Code reflects the lessons drawn from its monitoring programme, the feedback we receive (positive and negative) and complaints about Code members it receives. In addition we take account of guidance and suggestions we receive from TSI and the Supervisory Panel.

Since it was first drafted in early 2006 the Code has been developed and revised annually following discussions with the Supervisory Panel and OFT (and going forward with TSI). The Code was reviewed with the Panel and the OFT in 2012 and amended in February 2013 to take account of developments in the sector. The principal amendments were designed to:

- reflect fully the requirements of the Provision of Services Regulations 2009;

- clarify the MCS rules on sub-contracting;

- clarify further the requirements for deposits and advance payments;

- clarify the requirements for the setting of delivery and completion dates; and

- clarify the application procedures for conciliation and independent arbitration.

4.2 Updating the Bye-Laws

The RECC Bye-Laws were reviewed in parallel with the Code and also updated in February 2013. The principal amendments were designed to:

- simplify and shorten them where possible

- provide some additions to the ‘Definitions’ section;

- clarify members’ obligations in respect of complaints registered;

- clarify members’ obligations in respect of probationary status.

The Code and the Bye-Laws were reviewed by the TSI as part of the procedures to transfer Code approval from OFT to TSI. The Code and the Bye-Laws were then amended slightly in April 2013 in order to replace all references to OFT with references to TSI.

4.3 Supervisory Panel

The Supervisory Panel oversees and advises on the running of the Code.The governance of the Supevisory Panel is set out in full in the Bye-Laws. Its members are independent of the RECC Executive, and a majority of them including the Chair must be independent of the sector as well. From its second meeting in 2006 until July 2012 the Panel was chaired by Dr Gill Owen. Since her departure the Panel has been chaired by David Laird. In 2013 the Panel met four times, on: 20 March, 26 June, 18 September and 11 December. The Panel’s responsibilities are broadly to:

- review and update the documentation relating to the Scheme, including the Code;

- oversee the implementation of the Monitoring Strategy;

- review RECC Members’ complaince with the Code based on the results of monitoring using the methods agreed with the TSI;

- agree members of the Non-Compliance Panel, the Applications Panel and the Appeals Panel;

- establish such Expert Groups as it may consider necessary to advise it in carrying out its responsibilities; and

- review any reports presented to it by the Executive.

The Supervisory Panel Meeting Notes are available on the website here: https://www.recc.org.uk/scheme/supervisory-panel/meetings-notes

5. Promoting the Code

Throughout 2013 RECC has continued to take every opportunity to promote the benefits of the Code, and the consumer protection it offers, including through:

- attending and presenting the Code at industry and other related conferencees and exhibitions;

- publishing a quarterly newsletter to update members with developments in the Code and the wider sector;

- ensuring that only RECC members use the RECC logo and that they use it correctly and in line with the guidelines on the website;

- informing members about how they can use the TSI approved logo and be listed on the associated My Local Services website;

- providing members with high-quality leaflets explaining the key provisions of the Code and reequiring them to provide these leaflets to consumers;

- producing and circulating widely a set of ‘Top Tips’ for consumers to consult to avoid ‘being taken for a ride’ when signing a contract;

- liaising with regulatory and other bodies, including Trading Standards departments, Citizens Advice Consumer Service, the Advertising Standards Authority, Energy Saving Trust and the Companies Investigation Branch of the Insolvency Service;

- making sure the Code is clearly linked from other websites including: MCS, MCS Certification Bodies, Energy Saving Trust, BSI, OFT, DECC etc;

- responding to media enquiries; and

- providing evidence to Government and other bodies in response to consultations on, for example about the Feed-In Tariffs, the domestic Renewable Heat Incentive, the Green Deal and the wider energy efficiency market.

RECC has continued to devote the majority of its resources in 2013 to encouraging and monitoring members’ compliance with the Code. (Details of RECC’s monitoring work are set out in the next section.) To complement this work during 2013 RECC has continued to:

- carry out due diligence checks on businesses applying to join the Code;

- develop guidance on the website as well as updating and adding to a suite of model documents freely available to members and applicant members; and

- develop a comprehensive online training resource freely available to members.

5.1 Enhancing the services RECC provides to members

During 2013, RECC continued to develop and enhance the range of services it offers to members in several important ways. Below are some examples.

5.1.1 Primary Authority Arrangement with Slough Borough Council

RECC started discussions with Slough Borough Council (SBC) in 2013 with a view to SBC agreeing to act as RECC’s ‘Primary Authority’. According to this SBC would provide us and our members with dedicated advice on a range of different consumer protection issues, and checking the accuracy of our guidance and model documents so that Code members can rely on them. Primary Authority arrangments are overseen by the Better Regulation Development Office, part of the Department of Business, Innovation and Skills. More details are available here:

www.gov.uk/government/organisations/better-regulation-delivery-office

5.1.2 Quarterly newsletter

RECC launched a quarterly newsletter in July 2013. It provides Code members with an easy-to-read update of developments with the Code and the wider sector. It has been very well-received. The 2013 editions of the newsletter can be found here:

www.recc.org.uk/images/upload/news_79_RECC-Newsletter-July-2013.pdf

www.recc.org.uk/images/upload/news_87_RECC-Newsletter-Oct-2013.pdf

5.1.3 Independent Arbitration Service for micro-business consumers

RECC set up an independent arbitration service especially designed for ‘micro business’ consumers who would otherwise be ineligible for the independent arbitration service for domestic consumers. In 2013 one arbitration award was made under the new service. Details are here: www.recc.org.uk/consumers/how-to-complain-micro-business

5.1.4 Model performance and quotation documents for solar PV

RECC replaced its generic guidance on performance estimates with technology-specific guidance. The solar PV documents were published in 2013, with equivalent documents for solar thermal, heat pumps and biomass boilers due in 2014. They comprise guidance on consumer proposals and performance proposals as well as a model proposal letter, performance estimate, quotation and estimate. They can be found here: www.recc.org.uk/members/guidance-and-model-documents/solar-pv.6. Monitoring compliance with the Code

RECC uses a variety of tools to monitor compliance with the Code. RECC:

- requires all new applicants to give a series of legal undertakings and to complete a self-assessment check to demonstrate that they comply with the Code;

- undertakes an in-depth, on-site Compliance Audit Programme;

- operates a Mystery Shopping Programme;

- operates a Consumer Satisfaction Survey; and

- liaises closely with other enforcement bodies including Trading Standards departments, Advertising Standards Authrority and Citizens Advice.

6.1 Monitoring applicants

The first rung of the monitoring is the self-assessment compliance check that all applicants have to complete to declare that they are in a position to comply fully with the Code. Applicants are also required to make a number of declarations relating to the trading and solvency history of the company and the past behaviour of its directors, senior staff and close family members.

A copy of the application form, with declarations, and the self certification compliance check that applicants are required to complete is available on-line on the RECC website and can be downloaded from the following link: www.recc.org.uk/pdf/application-form.pdf

If the applicant is unable to make any of the required declarations they will automatically be investigated, for example by reference to administrators’ reports, Companies House, County Court records and other relevant sources. If the applicant does not appear to be in a position to comply with the Code they will be subjected to a complaince spot check. In addition, auditors will spot check a random selection of applicants who indicate full compliance and make all the required declarations.

The spot-check is a documents-based audit of the contract, the quotation, the workmanship warranty, the cancellation form, and a company’s website and other promotional materials. Auditors also check the adequacy of the third party client account and intended arrangements for deposit and warranty insurance. As a result of these checks applicants often make changes to their procedures and documents. Typically they will have been required to:

- change their advertising and marketing materials;

- adopt the model contract or change their contract terms; and/or

- open a client account or switch from a deposit to a client account.

6.1.1 Applications Panel decisions

RECC membership is dependent on the business obtaining a clean bill of health and so until the non–conformities or anomalies are addressed they will not be signed up to the scheme. Where a business is unable or unwilling to address such non-conformities or where RECC considers that one or more of the Circumstances for refusing Membership may have been met, the application will be referred to the independent Applications Panel for a decision. The ‘Circumstances for refusing Membership’ are set out on the RECC website: https://www.recc.org.uk/join/circumstances-for-refusing . The Applications Panel can decide that an application should be:

- accepted, without conditions;

- accepted with conditions e.g. subject to special conditions; or

- rejected.

During 2013 the indpendent Applications Panel met 11 times and considered 17 applications. Of these 17 applications 11 were rejected while 6 were accepted, 4 on a conditional basis.

Keith Richards continued to chair the Applications Panel, with six other Panel members available to be drawn on. During 2013 these were: Bryn Aldridge, James Court, Nina Dutta, Fiona Tittensor, Alastair Keir and Sarah Chambers (the last three from June 2013). Andrew McIlwraith continued to provide the independent secretariat to the Applications Panel.

Figure 6.1 Summary of Applications Panel activity 2013

| Number of Applications Panel meetings | 11 |

| Number of applications considered | 17 |

| Number of applications accepted | 6 |

Of which:

| 2 2 1 1 |

| Number of applications rejected | 12 |

6.2 Carrying out compliance audit visits

As a condition of membership, RECC members are required to co-operate with RECC’s compliance monitoring strategy, agreed with TSI. The compliance audit visit, the ‘gold standard’ of RECC’s monitoring activities, is a comprehensive and robust on-site inspection of RECC members’ businesses. The audit visit can take up to a whole day depending on the complexity of the member’s business model and the size of its operations.

The audits are carried out by independent auditors based around the country. They use a questionnaire devised by RECC to reflect the provisions of the Code. The auditors’ skills encompass consumer protection expertise, quality management expertise and systems audit expertise. RECC revises the questionnaire before every audit round to take on board any Code changes, lessons learned from previous audit rounds, legal or regulatory changes and feedback from members. The audit questionnaire is available on RECC’s website in a version that includes detailed guidance for members as to what auditors will be looking for: www.recc.org.uk/monitoring/audits

A sample of members to be audited is drawn up for each audit round. The sample consists of a combination of members selected at random supplemented by members about whom RECC has received complaints (irrespective of the outcome) or other relevant feedback. The sampling method is set out in more detail here:

www.recc.org.uk/pdf/process-for-selecting-members-for-audit.pdf

During the audit the auditor identifies with the member any areas of non-compliance and together they complete the audit questionnaire. The auditor then leaves a copy of the completed questionnaire with the members so that they can check it for factual accuracy. The auditor then submits the questionnaire to the RECC audit panel which moderates and scores all the completed questionnaires and then writes to the member to indicate the areas of non-conformity and the actions required to resolve these.

Members submit their responses to any non-conformities to RECC and then work with the auditors to reach full compliance with the Code. If a member appears to be unwilling or unable to address any non-conformities, they may be referred to the Compliance Team, in accordance with the Bye-Laws, for a decision on how any non-compliance with the Code should be addressed.

Members’ audit results are scored according to a reverse weighted system that gives greater weight to certain key provisions of the Code. Members thus score 0 if they are totally compliant. Thereafter, the lower the member’s score, the better their level of compliance. Members that score 8 negative points or fewer are deemed to have passed the audit.

In 2013, RECC conducted two rounds of audits. It is important to note that 327 members were initially selected for an audit. Before the visits commence several companies are removed from the selection due to various reasons, such as the company ceasing to trade. Although this does reduce the number of audit compliance visits for the round, it was counterbalanced by the second round of audits during the autumn.

6.2.1 Results of spring 2013 round of audit visits

In the spring 2013 round of compliance audit visits 191 audit visits were initiated, 74 of these were cancelled before the audit visit while 117 visits went ahead.

The scores were as follows:

- 10 of these 117 members (9%) passed, 3 of which (3%) scored a perfect 0;

- 107 members failed, scoring 9 negative points or more, of which 50 members (43) scored between 9 and 50 and 31 members (26%) scored between 51 and 99;

- 26 members (22%) scored 100 negative points or more, indicating a very serious level of non-compliance with the Code;

- follow-up letters were sent to all audited members (a number of which either ceased trading or left the Code shortly after the audit visit took place);

- 63 of the 107 who initially failed have now passed and most of the rest were in the final stages of achieving full compliance;

- 10 of the 26 members who scored 100 negative points or more have been referred to the Compliance Team; the others are no longer members of RECC or have been subject to further monitoring since the audit.

On the face of it, Figure 6.2 below indicates a disappointing set of results. However, it should be noted that the audit questionnaire is extremely thorough. The audit process is considered a constructive process and thus although initial scores may be high, most members put time and effort into achieving compliance. Considerable credit should be given to those who pass first time round.

Nonetheless, the members with very high negative scores are the cause of grave concern. RECC has written individually to each of these members to make it clear that they must take urgent action to bring their businesses into full compliance with the Code. Of the 26 members (22%) who scored over 100 negative points:

- 10 members had responded to RECC and have now passed the Audit;

- 9 members had been referred to the NCP;

- 1 member requested a paid-for audit to help them reach compliance;

- 2 members had ceased trading since the date of the audit;

- 4 members were subject to further monitoring.

Fig 6.2 Audit visits carried out in spring 2013: breakdown of negative scores

6.2.2 Results of autumn 2013 round of audit visits

In the autumn 2013 round of compliance audit visits 136 audit visits were initiated, 47 were cancelled before the audit visit, while 89 visits went ahead. The scores were as follows:

- 3 of these 89 members (1%) passed, 2 of which (2%) scored a perfect 0;

- 86 of these 89 members failed, scoring 9 negative points or more, of which 28 members (31%) scored between 9 and 50 and 29 members (33%) scored between 51 and 99;

- 18 members (20%) scored 100 negative points or more, indicating a potentially very serious level of non-compliance with the Code;

- due to companies that were audited later in the round we are awaiting the audit reports for 11 members.

- 13 of the 86 who initially failed have now passed, while most of the others were in the final stages of achieving full compliance.

Follow-up letters were sent to all audited members (1 company left the Code shortly after the audit visit took place). These highlight any areas of non-compliance and request documentation and evidence to show that these have been addressed. Each auditor will carry out a detailed review and write a response to the company on the basis of any new submissions. If any outstanding issues remain after the final deadline these are reviewed by the Non-Compliance committee.

Fig 6.3 Audit visits carried out in autumn 2013: breakdown of negative scores

Figure 6.4 (below) shows the principal areas of non-compliance picked up during the audit compliance visits for each round. These are displayed as a percentage of the whole round in order to allow comparison. The most frequent area of non-compliance in the spring round was Pre-contractual Information though this decreased in the autumn round.

RECC continues to provide model documents including quotations and pre-contractual information. These are available to members free of charge and have been developed in order to comply with both the requirements of the Code and the relevant consumer protection legislation. RECC has continued to work on providing the detailed guidance on additional technologies which should in turn reduce this issue for the following audit rounds.

Both section 13 (Design, delivery and installation) and section 18 (Awareness of the Code) were common areas of non-compliance within the spring round. As you can see from the graph below non-compliance in these areas did reduce for autumn round.

In the autumn round the most frequent area of non-compliance was cancellation rights. To assist members in this area, RECC makes model cancellation forms and guidance available to all members as well as including further information in the newsletter.

Fig 6.4 Areas of non-compliance in both 2013 audit rounds

6.2.2 Compliance auditors working for RECC in 2013

During 2013 15 independent auditors carried out compliance audit visits on behalf of RECC:

| Virginia Barstow | Yvonne McGivern |

| Hamish Bell | Colin Meek |

| Sue Bloomfield | Carole Pitkeathley |

| Clare Carden | Jackie Robinson |

| Louise David | Geoff Stow |

| David Elwood | Fiona Tittensor |

| Fiona Flynn | Paul Voysey |

| Steve Gillon |

6.3 Mystery shopping

RECC conducts targeted mystery shopping exercises with a view to checking compliance of members considered to pose a risk high of consumer detriment. RECC has a team of mystery shoppers spread throughout the country who assist us by carrying out such mystery shopping exercises.

RECC members are selected for mystery shopping on the recommendation of auditors, as a result of complaints or other intelligence received, or because they exhibit a high risk of non-compliance for some other reason. The principal focus of this exercise is to monitor selling techniques and pre-contractual information provided by the subscribers.

Mystery shoppers complete RECC’s bespoke evaluation forms soon after their contact with the members. RECC reviews the results and then decides what follow-up action is appropriate. Follow-up action might range from an advisory letter to referral to the NCP, in line with the Bye-Laws.

As with the audit, where non-conformity is identified, RECC notifies the member and requires them to address the problems or, where it is evident the business is unwilling to cooperate, passes them to the NCP. During 2013:

- RECC recruited several new shoppers;

- RECC commissioned 42 ‘shops’, 41 of members, 1 of an applicant;

- RECC received reports of 33 visits to shoppers’ homes;

- RECC received 2 reports regarding an initial sales call only;

- 7 of the ‘shops’ commissioned did not go ahead for a variety of reasons.

Of the mystery shops undertaken, the results from 28 members (around 85 % of visits) gave RECC considerable cause for concern. Of these:

- 17 members were already subject to additional compliance monitoring

- 9 members have since been referred to the Compliance Team

- 2 businesses were no longer members of RECC.

6.4 Surveying consumer satisfaction

RECC distributed a Customer Satisfaction Survey (CSS) questionnaire that consumers return directly. In this way consumers provide feedback on the experience they have had with members. The questionnaire, which covers all technologies, is available:

- online – on the RECC website either in hard copy to download or to respond to directly online;

- through members who provide consumers with a CSS questionnaire to fill out;

- through QANW - all consumers whose installations are registered under the DAWWI Scheme receive a CSS questionnaire with their policy documentation.

RECC analyses all returned questionnaires, including the ‘free-text’ comments section. Where a member attracts negative feedback or comments, RECC assesses whether the case requires further scrutiny. If they do then the member may be added to the list of members subject to an audit or a mystery shop in the next round. Consumers can indicate on the form whether they want their feedback to be registered as a complaint to be followed up and resolved. During 2013:

- 1,646 questionnaires were returned directly to RECC ;

- in 2013 the majority of respondents gave positive feedback about members’ compliance:

- 96% of consumers said they were provided with sufficient information about the system before signing a contract;

- 97% said that the performance of the system was clearly explained to them as well as what this meant in financial terms;

- 95% said they were made aware of their cancellation rights

- 96% of consumers said they were provided with sufficient information about the system before signing a contract;

- In 2014 the majority of respondents gave positive feedback about members:

- 98% of consumers said they were provided with sufficient information about the system before signing a contract;

- 98% said that the performance of the system was clearly explained to them as well as what this meant in financial terms;

- 98% said they were made aware of their cancellation rights.

- 98% of consumers said they were provided with sufficient information about the system before signing a contract;

Fig 6.5 Breakdown of consumer satisfaction questionnaire responses

Fig 6.6 Satisfaction rates with system function and company selling methods

The CSS questionnaire also asks consumers to respond to two general satisfaction questions:

- how satisfied are you with the way the system was installed?

- how satisfied are you with the way the system was sold to you?

Figures 6.5 and 6.6 above show that in 2013:

- the majority of consumers were satisfied with the way the system was installed overall, with an average satisfaction score of 9.9/10;

- 50% of consumers rated the way the system was installed as 10/10;

- the majority of consumers are satisfied with the way the system was sold to them overall, with average satisfaction scoring at 9/10;

- 53% of consumers rated the way they were sold the system as 10/10.

7. Enforcing compliance with the Code

The independent Non-Compliance Panel (NCP) considers suspected breaches of the Code referred to it by RECC. The governance of the NCP is set out in full in the RECC Bye-Laws. All NCP Members are independent of the RECC Executive and a majority, including the Chair, is independent of the sector. In 2013 the NCP met 9 times and held 6 Hearings.

The Chairman of the NCP is Mary Symes. She has held this post since August 2012. In 2013 there was a pool of four other NCP members: Amanda McIntyre, Elizabeth Stallibrass (from July 2013), Jim Thornycroft and Alan Wilson.

RECC members may be referred to the Panel because of:

- suspected breaches of the Code;

- failure to co-operate with an audit or to complete the audit follow-up;

- indications of non-compliance from mystery shopping results;

- indications of frequent or systematic non-compliance from complaints; or

- indications of non-compliance from other intelligence sources.

The Panel may decide, on the basis of the evidence before it, to convene an independent Hearing at which both parties can put their case. Of the 9 cases the NCP considered in 2013 7 were referred to an independent Hearing.

Of the cases referred to an independent Hearing:

- two members had their membership terminated;

- two members were subjected to a six-month probationary period with enhanced monitoring;

- one member’s customer database was subject to monthly inspection followed by a further audit after three months;

- one member was required to be audited and to inform RECC of new employees.

Figure 7.1 Summary of independent Non-Compliance Panel activity in 2013

| Number of independent NCP meetings held | 5 |

| Number of members considered at meetings | 9 |

Of which the NCP:

| 6 1 2 |

| Number of independent NCP Hearings held | 6 |

| Number of members invited to attend Hearings | 6 |

Of which the NCP:

| 2 1 1 2 |

8. Resolving complaints in respect of members

Consumers with complaints are required to seek a resolution with the RECC member in writing before registering their complaint with RECC. If they do not succeed, they can register their complaint using the online complaints form on RECC’s website: https://www.recc.org.uk/complaint-form . If consumers cannot access the internet they can register their complaint by post using the hard copy complaints form.

The Ombudsmans Investigation Service defines a complaint as: "Any expression of dissatisfaction, whether oral or written, and whether justified or not, from or on behalf of an eligible complainant about the provision of, or failure to provide, a service."

In 2013 consumers registered 1,301 complaints with RECC. Of these 33 % were for RECC to handle while 48% were feedback complaints in which consumers were not seeking redress but simply wanted to register their dissatisfaction. Complaints about non-members are also recorded as feedback and accounted for 15% of the total feedback complaints. Where necessary, the consumer is advised to contact Trading Standards. Where the non-member has sub-contracted work to a RECC member RECC holds the member responsible and will seek to resolve the complaint through them.

The complaints registered in 2013 were in respect of 521 different RECC members/ex-members. 336 of these members had had just one complaint registered against them; the remainder had more complaints registered against them, with 9 having 20 or more. In some cases RECC is not the appropriate body to handle the complaint registered. For example, complaints predominantly about technical issues made up 18 per cent of all complaints registered in 2013. These complaints were passed to the member’s MCS Certification Body, though RECC continues to liaise with both parties and to help seek a resolution.

These figures do not reflect the total consumer detriment since they exclude those reported to other bodies and those that went unreported. In all RECC has registered complaints in respect of 972 members and ex-members, some 25% of RECC’s total members. (521 of these businesses have only ever had one complaint registered about them, while the remainder have had more, and 6 have had over 50.)

Fig 8.1 Complaints and feedback registered with RECC in 2013

Fig 8.2 Total number of complaints registered with RECC by month in 2013

Fig 8.3 Breakdown of complaints by category

Fig 8.4 Complaints registered with RECC in 2013 by technology

(In 2013 1.1% of all domestic solar PV installations were the subject of a complaint registered with RECC:

937 out of 85,755 (313 MW) (see page 3). There were many fewer installations for the other technloogies. )

Fig 8.5 Complaints registered with RECC in 2013 by technology compared with 2012

| Technology | Complaints 2013 | Complaints 2012 |

| ASHP | 64 | 32 |

| Biomass | 45 | 11 |

| GSHP | 16 | 10 |

| Multiple Technologies | 51 | 20 |

| Other (non-MCS ) | 29 | 3 |

| Solar PV | 937 | 1039 |

| Solar Thermal | 37 | 27 |

| Unknown | 104 | 61 |

| Wind turbine | 18 | 22 |

| TOTAL | 1,301 | 1,225 |

Fig 8.6 Complaints registered with RECC in 2013 broken down by issue

8.1 Principal issues underlying complaints

The principal issues underlying the complaints set out in Figure 8.6 above are explained in more detail in this section.

Technical / workmanship

Complaints which arise from technical faults with consumers’ installations, or in which installers’ workmanship is called in to question (largely due to damaged caused to the consumer’s property during the installation).

Financial performance

Complaints which arise when a consumer is concerned that the financial projections detailed in their contract are incorrect. Often consumers complain that they think that they have been mis-sold a system because the member inflated the financial return figures they provided and shortened the projected ‘payback’ periods.

Missing documents

Complaints which arise when consumers have not been provided with the relevant paperwork for their installation, as detailed in the Renewable Energy Consumer Code/ MCS standards. The most common complaints concern missing warranty/ guarantee documents and missing MCS Certificates.

Deposits and/or advance payments

Complaints which arise when consumers who have cancelled their contract within or outside of the cooling off period (or the member has found the installation to be unsuitable for the consumer’s property), and the member has not returned the consumer’s deposit, or is withholding a proportion of it. This category also includes complaints which arise where consumers have made advance payments for pre-contractual activities, for example surveys and are looking for them to be refunded.

Feed-In Tariff loss

Complaints which arise when consumers think they have ‘lost’ FIT payments to which they are/were entitled and are seeking compensation for this. This could be as a result of a period in which a system was not working properly, or as a result of Government changes to the FIT rate, where consumers have contracted with a member based on their receiving a higher FIT rate, but missed the deadline through no fault of their own, and thus are receive a lower FIT rate than they expected.

Incorrect performance estimates

Complaints which arise from consumers’ concerns that their system is not generating in line with the SAP estimate the member provided them with in the contract. This may have arisen as a result of a technical issue with the siting, or the member may have calculated the SAP figures incorrectly.

Contractual discrepancies

Complaints which arise when consumers claim that the system they have been provided with is different from the system stipulated in the contract. These complaints frequently arise where a member has sourced equipment from different manufacturers from those listed in the contract, or where the member has not supplied the consumer with goods to which they are contractually entitled, e.g. a remote monitor. This category also includes complaints about the incorrect orientation of panels and the size of systems.

Customer service

Complaints which arise as a result members providing poor customer service to the consumer. The majority of these complaints concern instances of pressure selling during home visits, lack of communication form the member (both before and after the contract has been signed), unexplained delays, and the member’s poor complaints handling. Often these issues are raised by consumers who allege that members have breached certain sections of the Code.

Insurance claim

Complaints which arise where a member has ceased trading and for various reasons the insurance backed guarantee is not valid, or the member misled the consumer into believing that their workmanship warranty would be protected but is not.

Other

The complaints in this category do not fit into any of the categories listed above. They comprise a range of issues within complaints, for example where the member is trying to enforce a non-existent contract, or a void contract, and the consumer is seeking advice as to whether they owe the member money, or whether the contract can be enforced. Also included here are complaints which involve the failure to remove scaffolding / materials following an installation.

8.2 Complaints resolution

RECC's team of 8 legally-trained complaints handlers work hard to resolve complaints that fall within RECC’s remit. In 2013 our complaints handlers managed to resolve 4 out of 5 of the complaints allocated to them. (See chart below.)

Fig 8.7 Breakdown of how complaints were resolved in 2013

Not all complaints RECC receives require a resolution. Some are more in the nature of feedback from consumers or others who simply want to alert RECC to certain issues.

Complaints are generally resolved by the member addressing the problem, for example refunding a deposit, reducing the price or providing missing items. Four out of five complaints not resolved by the member are resolved by RECC complaint handlers who mediate between the consumer and member. In a small minority of cases where complaints are not resolved at this level consumers may refer them to independent conciliation and or, in a few cases, independent arbitration. In some other cases consumers decide to use the small claims procedure or to seek resolution of their complaint through another source such as their credit card company, for example.

Of the 218 complaints which RECC resolved directly in 2013 it took on average 18.6 weeks to resolve each one. However, when another organisation was involved (such as an MCS Certification Body) it took on average 23.6 weeks to resolve each one.

Fig 8.8 Length of time taken to resolve complaints in 2013

Fig 8.9 Length of time in weeks taken to resolve complaints by technology in 2013

8.3 Conciliation service

RECC provides a free conciliation service to members and consumers where complaints cannot be resolved. The conciliation service is provided by IDRS Ltd. RECC also retains the services of two independent conciliators. In 2013 a total of 25 complaints were referred to conciliation (see chart below). Of these:

- in 6 cases settlement was reached;

- in 5 of the 6 cases there was a full and final settlement;

- in 1 of the 6 cases the member accepted the settlement but did not pay compensation;

- in 19 cases settlement was not reached;

- in 14 of the 19 cases the consusmer then referred the complaint to the independent arbitration service;

- in 2 of the 19 cases the consumer then pursued the case through the courts; and

- in 3 of the 19 cases no further action was taken.

Fig 8.8 Cases referred to conciliation in 2013

| Category | Numbers | % of total | Explanation |

| Total cases referred, of which: | 25 | 100 | |

| Settlement reached, of which: | 6 | 24 | The parties either accepted the independent conciliator's recommendation or reached an agreement through IDRS. |

|

5 | 20 | In full and final settlement of complaint: no further action required. |

|

1 | 4 | Member accepted recommendation but did not pay compensation. |

| Settlement not reached, of which: | 19 | 76 | The parties could not reach an agreement during the conciliation process. |

|

14 | 56 | |

|

2 | 8 | |

|

3 | 12 |

8.4 Independent arbitration service

Where a complaint remains unresolved, a consumer may refer it to the low-cost independent arbitration service. The service is provided by IDRS Ltd. If a consumer asks to use the arbitration service the RECC member must agree. Consumers and members are each required to contribute £100 + VAT to the cost of the service, with RECC contributing the balance. The arbitrator’s award is binding and enforceable, and is an alternative to a court judgment. The arbitration service rules can be found here: www.recc.org.uk/pdf/arbitration-service.pdf . In 2013:

- 18 complaints were referred to the independent arbitration service;

- in 9 cases the arbitrator found the consumer’s claim against a RECC member was fully justified;

- in 7 cases the arbitrator found the consumer’s claim against a RECC member was justified in part;

- in these 16 cases the arbitrator ordered the RECC member to refund the consumer’s registration fee as part of the award;

- in these 16 cases the arbitrator also made a financial award ranging from £100 to £9,980;

- in 6 cases the arbitrator also made a non-financial award, for example for missing documents to be supplied, a survey to be provided or an invoice to be withdrawn;

- in 2 cases the arbitrator dismissed the consumer’s claim and did not order the consumer’s registration fee to be refunded.

In 2013 RECC worked with CEDR, the company that owns IDRS Ltd, to set up the independent micro-business arbitration scheme. It is designed for those consumers who are not domestic but are close to domestic. For example they could be small farmers, or run a small hotel or offer bed and breakfast accommodation. Such consumers do not have access to RECC’s complaint-handling process, but may proceed directly to the arbitration service. The rules can be found here: www.recc.org.uk/pdf/arbitration-scheme-for-micro-business-disputes.pdf

Fig. 8.9 Cases referred to arbitration in 2013

| Category | Numbers | % of total | Explanation |

| Total complaints referred to arbitration, of which: | 18 | 100 | |

| consumer's claim succeeded: | 16 | 89 | Member found to have failed in its duty of care to the consumer |

|

9 | 50 | |

|

7 | 39 | |

| consumer's claim dismissed | 2 | 11 | |

| consumers registration fee: | Consumers pay £100 + VAT registration fee for arbitration | ||

|

16 | 89 | |

|

2 | 11 | |

| type of award made: | |||

|

15 | 83 | Awards ranging from £100 -£9,980 made in addition to registration fee |

|

6 | 33 | E.g. an order that documents or survey be provided, invoice be cancelled &c |

During 2013 one case was referred to the microbusiness arbitration scheme. To qualify for this service, a micro-business consumer must declare that they have:

- an annual consumption of

(a) electricity of not more than 55,000 kWh; or

(b) gas of not more than 200,000 kWh; or

- (a) fewer than 10 employees (or their full time equivalent); and

(b) an annual turnover or annual balance sheet total not exceeding £1.5 million.

9. Resourcing the team

Operations

Virginia Graham – Chief Executive, Renewable Energy Assurance Ltd

Mark Cutler – Head of Operations

Ciaran Burns – Technical Advisor

Membership

Aida Razgunaite – Membership Manager

Sam Bourn – Membership Assistant, half-time (from 11 July 2013)

Monitoring

Andrea Kourra – Monitoring Manager (until 7 August 2013)

Carrie Principe – Monitoring Manager (from 8 August 2013)

Sam Bourn – Monitoring Assistant, half-time (from 11 July 2013)

Independent Panels

Sian Morrissey - Head of Panels Liaison

Lorraine Haskell – Panels Manager

Complaints

Sarah Rubinson – Complaints Manager

Sania Khan – Complaints Case Worker (from 15 August 2013)

Rebecca Robbins – Complaints Case Worker

Abena Simpey - Complaints Case Worker

Sumandeep Sohi - Complaints Case Worker

Eileen Brennan – Complaints Case Worker, working off-site

Anna Hills – Complaints Case Worker, working off-site

Annabel Howcroft – Complaints Case Worker, working off-site

Victoria Thorp – Complaints Case Worker, working off-site

The RECC team, pictured left, works tirelessly to promote and enforce the Code in a robust and even-handed way. With backgrounds in economics, law, trading standards, dispute resolution, customer service, renewable technologies and environmental management, between us, we have a wealth of knowledge and experience available to consumers and members alike. We are always happy to answer questions and provide advice on a range of different subjects. What makes the team really special is our committment to our jobs.

RECC’s expenditure on administering the Code in 2013 broke down as set out in the chart below. As in other years a high proportion of RECC’s expenditure was on its monitoring and commpliance activities which accounted for 35% of total expenditure, compared with staff, employment and other administrative costs which accounted for 36% of total expenditure.

Fig 9.1 Breakdown of RECC's expenditure in 2013

10. Looking ahead

RECC is pleased to be going forward in partnership with TSI. 2013 was the first year of this new partnership. We are confident that we can successfully build on the many synergies we have with enforcement agencies around the UK and learn from our future association. RECC is stepping into the new era with confidence and optimism.

The framework of Government incentives, particuarly the domestic Feed-In Tariff, is much more stable and predictable than it was in 2012. So we hope that the coming year will be a less difficult one for RECC members and consumers alike. We hope too that the level of complaints being registered with RECC will decrease as consumer protection standards increase across the sector. This report shows that there has been a considerable lag, however, and that levels of consumer detriment remain high.

The Domestic Renewable Heat Incentive will see the framework expand to embrace technologies such as ground and air source heat pumps, biomass boilers and solar thermal systems. This expansion will bring its own challenges for consumer protection, and RECC is gearing up to be ready for it as well as for the other challenges that are bound to emerge.

28 March 2014